Artificial Intelligence is the Future of Venture Capital

The amount of available data to make decisions continues to explode with each passing year and threatens to overwhelm human operators. After spending decades as a niche field in academics, over the past twenty years AI has finally reached the hands of the general public through hastening compute power and freer exchange of information over the Internet. While it won’t strictly do your job for you, it still is an invaluable tool that should be put to use whenever applicable.

The Amount of Data Available is Insurmountable – And Still Growing

As technology has progressed, the number of Internet-connected devices gathering data has become a near-insurmountable hurdle. Nothing exemplifies this better than the 2 billion-strong IPv4 address space originally developed for Internet-connected devices being found wildly insufficient to meet demand; it was then supplanted by the more robust IPv6. Further advances such as the concept of the Internet of Things means that if something can be measured, it also can easily be tracked and collected, including business operation aspects such as transaction times, temperatures, vehicle movements, and foot traffic. This explosion has led to the amount of resulting data being too great for humans to administer hands-on; even if you could hire experts and pay a premium for their services, they are still limited by human factors in ways computers are not. Self-driving cars, natural language processing, and risk management all have AI has a significant contributor to their success.

Where AI enters the picture is that not only is it able to react more quickly than humans can, but it is also able to learn and grow in a manner that was previously only known to exist in living beings. Neural networks are trained using this data ever-growing mountain of data and thrive on its existence. The growth pattern of artificial intelligence is comprised of simply setting KPIs as a goal condition, and over time through trial and error, AI will be able to determine which combination of variables will provide the best end results, even in complicated multivariable relationships. AI scales far better than human operators ever could, and while operators are still needed to guide and maintain the systems, the algorithms pay for themselves many times over in the process.

How Venture Capital Can Benefit from AI

AI can be a product offering in and of itself, but it’s applicable to many different industries beyond fintech. Even the act of investing itself can be AI-driven. Churning throughout the massive amount of data in the market can be used to identify trends that a human may mistake for noise and pass over. Risk and return can be modeled more quickly and confidently than a human. AI puts investors in the driver’s seat of a vehicle; your objective is to simply not run it off the road and stay within your lane, and it will get you to where your destination is far more efficiently and quickly than walking.

Further, using AI to drive investment policy helps avoid flaws that are entirely too human. Overconfidence, biases, and information overload could lead to a poor decision, while a computer suffers no such shortcomings. Personal factors such as self-doubt, stress, or even the simple vagaries of day to day life could change how a decision is made on two separate days, even with all else being equal. AI keeps you honest with a regularity that’s not always available in humans.

Artificial Intelligence Drives Proper Decision Making

At this stage in the game, a poor decision can be incredibly costly. Knowledge is power; no one can ever make a decision with truly perfect information, but it will still behoove you to get as close to as perfect information as you possibly can. You’re going to have to think ahead a quarter, a year, two years, or even more to predict what the market is going to need – a tall order in even prime economic conditions, but with the pandemic’s wildly chaotic playing field, it’s become even more challenging, especially because it’s so hard to gauge how or when it is going to contract or spread.

The proliferation of ever-increasing amounts of data has driven AI as one of fintech’s hottest areas, with an estimated $6.67 billion US in 2019 that is expected to grow to $22.6 billion by 2025. AI’s applications in the fintech market include process automation, data management and analysis, big data evaluation, and machine learning and will become a hot commodity in that not only will they help firms get better at what they do, but will become viable investment options in and of themselves. Finacle is a great example of these applications, as it uses AI to scan documents for regulatory compliance to assist human review, which increases both speed and accuracy and allows for greater throughput with fewer mistakes. Credit and lending are going to benefit greatly from these applications, as right now the market is incredibly cautious and constrained due to high unemployment.

Beijing-based firm Hone created a database of 30,000 deals over the past decade and observed whether each deal successfully reached a Series A round. 400 characteristics were considered, including historical conversion rates, money raised, and areas of expertise. This field was narrowed down to the 20 most accessible KPIs, and the experiment discovered that startups that failed to advance to Series A had an average seed investment of $0.5 million, while startups that did progress held an average of $1.5 million, suggesting that there is a greater chance of success in larger deals. Additionally, it discovered startups with founders from different universities were more likely to succeed, attributed to a greater diversity of perspectives; a factor not likely to have been considered by a human.

Of course, simply setting an AI system loose with your funds is a poor idea; if it were that simple, everyone would do it. Rather, AI can only show you the doors that you must then walk through. Due diligence is one of the most laborious processes that AI can help you streamline, but it won’t do the job for you, and this is where the human values of leadership and accountability come in.

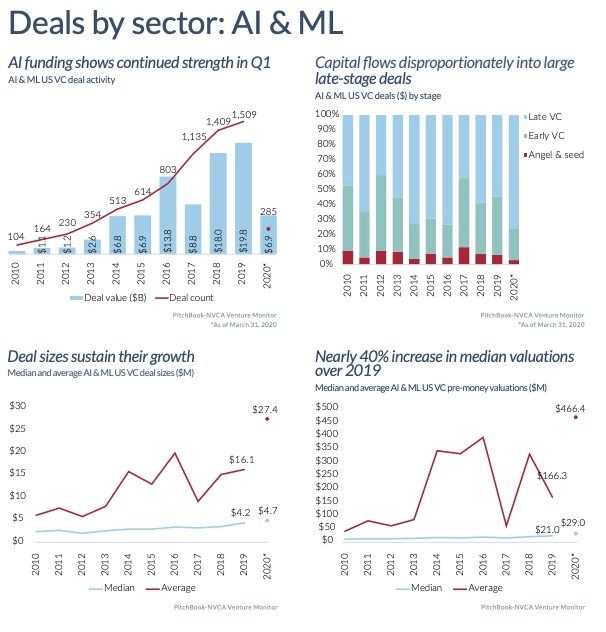

How the AI Startup Sector Has Progressed

Even in the overall venture capital dip of 2019, AI reached a personal bumper year for money raised by startups, raising $18.457 billion USD over 1,356 companies, after raising $16.80 billion in 2018. Q1 2020 showed a $6.9b investment, another record-setting pace prior to the coronavirus outbreak. Although AI has slumped in the wake of the pandemic, as many other fields have, AI in healthcare represented 84 deals in Q2, up from 82 in Q1. The most prominent reason for AI’s growth is that it is the equivalent of selling shovels during a gold rush, as the technology is applicable to a wide variety of fields, suggesting that AI will simply shift to the sector it is most needed in. Beyond medical, further growth is likely to grow in fields that have avoided being impacted strongly by the pandemic, such as cybersecurity, smart infrastructure, and further research into AI itself.

Concluding Thoughts

Artificial intelligence is a field that has something to offer to everyone. Whether you want to augment your own activities or searching for the next big prospect, it’s a tool that should not be overlooked. It’s unlikely that it will ever completely supplant human leadership, but at the same time it is both a hot sector and an edge that should not be overlooked.

If you have questions about our fund or would like to be sent investor documents, you can contact our investor relations department at [email protected].