Fintech’s Priorities Shift Due to Market Winds

Fintech is a sector that encompasses a bevy of offerings, from credit and lending, regulatory compliance, personal finance, insurance, capital markets, money transfer, to real estate. This umbrella consists of industries with wildly different priorities and needs, so shifting market conditions could benefit some industries and harm others. The pandemic has changed the course of how business is done, which will have knock-on effects throughout the entire sector

Where the Market Stands with the Pandemic

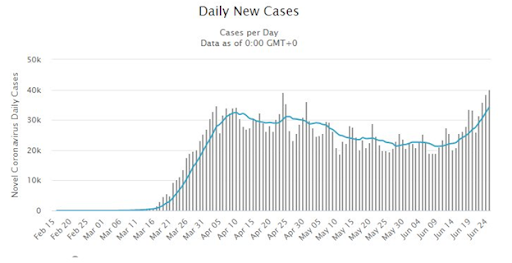

The COVID-19 pandemic has constrained how people spend money. Much of the fintech sector’s value proposition revolves in facilitating transactions, which have slowed due to decreased opportunities and stymied income. Unemployment has spiked due to businesses being mandated to reduce capacity or shut their doors entirely, and spending has shifted to focus on essential items rather than tourism, entertainment, and service, which are sectors that fintech has typically thrived in. As of the past few weeks, the number of COVID cases along the west coast and southern US has spiked drastically and re-accelerated after a period of relative flattening and decline. It remains to be seen how state governments will respond to swelling case numbers, but with vaccines still in trial with no clear availability date, it is clear that the disease will be a factor in some form throughout the rest of the year, at the very least.

Coronavirus New Cases (Source: Worldometers)

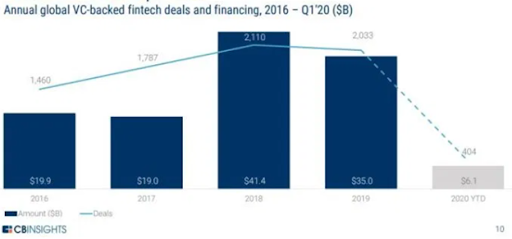

With that stage being set, venture capital-backed fintech has had its worst quarter overall over the past two years because of the pandemic, with both deal number and amount invested shrinking drastically. There is a great deal of uncertainty right now following a period of stability with COVID-19, and investors have chosen to focus more on strengthening existing portfolios rather than taking on new deals. The goals for investors in the sector have also changed to more long-term outlooks, with caution becoming the new watchword in a historically fast-paced area of the market. With lockdowns being prominent in the early stage of the pandemic, and with restrictions being largely eased despite case activity being even higher than the initial outbreak, investors have become quite gun-shy about short term deals as it has become impossible to predict where the disease will stand even a month into the future. In particular, credit and lending has contracted as it typically does in uncertain times, even more so due to the pandemic’s unpredictable nature.

Where Fintech’s Opportunities Lie

Bear in mind that fintech covers a wide range of services, so while overall activity across the entire sector has dropped in aggregate, there have been seismic shifts in how that breakdown is occurring. As stated before, people are still spending, but how and where their money is being spent has changed drastically, which requires new solutions. More than ever, you will need to work in the environment you have, rather than the one you might want. Overall transactions and volume have decreased but spending in essential areas such as grocery stores has increased drastically, and e-commerce and delivery have spiked as people buy more from home and curbside. Additionally, the banking sector has continued to fare well, as customers prefer virtual meetings and contactless payments. Even the recent stimulus payments have represented an opportunity, as the US government contracted with consumer digital finance payment platforms to disburse funds to individuals who did not have their bank account on file with the IRS.

Money still easily moves even in a downturn; the only difference is where and how it is being sent. Offerings such as Square and CashApp have thrived even in adverse conditions by hooking into these unique market needs, focusing on essentials such as stimulus funds, tax refunds, and payroll deposits, and including individuals in the investment market with fractional investing and recurring purchases. Cryptocurrency and digital assets have enjoyed surges recently as well within these apps, as never before seen levels of quantitative easing have driven investors to seek uncorrelated assets. It’s important to not be so concerned about the state of the market itself, but rather how that market state compels people to spend differently than they otherwise might have.

Artificial Intelligence Drives Proper Decision Making

At this stage in the game, a poor decision can be incredibly costly. Knowledge is power; no one can ever make a decision with truly perfect information, but it will still behoove you to get as close to as perfect information as you possibly can. You’re going to have to think ahead a quarter, a year, two years, or even more to predict what the market is going to need – a tall order in even prime economic conditions, but with the pandemic’s wildly chaotic playing field, it’s become even more challenging, especially because it’s so hard to gauge how or when it is going to contract or spread.

The proliferation of ever-increasing amounts of data has driven AI as one of fintech’s hottest areas, with an estimated $6.67 billion US in 2019 that is expected to grow to $22.6 billion by 2025. AI’s applications in the fintech market include process automation, data management and analysis, big data evaluation, and machine learning and will become a hot commodity in that not only will they help firms get better at what they do, but will become viable investment options in and of themselves. Finacle is a great example of these applications, as it uses AI to scan documents for regulatory compliance to assist human review, which increases both speed and accuracy and allows for greater throughput with fewer mistakes. Credit and lending are going to benefit greatly from these applications, as right now the market is incredibly cautious and constrained due to high unemployment.

Concluding Thoughts

While fintech appears to be struggling due to the adverse economy at first glance, it is more a case of shifting priorities. The pandemic has rewired the market’s needs and expectations in ways no one could have predicted, and firms that can read and react to them will thrive even in the potential bear market over the next few years. The adage of finding the market need and filling it will serve you well even in turbulent economic waters. Fintech’s brightest spots during the pandemic will ultimately fall into two categories: those that make existing processes more efficient, and those that are able to hook into what the public demands more closely than others.

If you have questions about our fund or would like to be sent investor documents, you can contact our investor relations department at [email protected].