How 2023 is Going to Rebuild the Digital Asset Sphere

It’s undisputed that 2022 was a succession of some of crypto’s worst news to date, as fallout from the FTX and Terra/Luna debacles along with other uncontrollable external factors sent markets into a nosedive. However, once the fallout settled, it revealed that not only did markets reach a floor higher than anyone would have expected considering the scope of the incidents, but that they would also find a way to claw back some of the losses that were sustained. Although we are only two months into the year, it’s clear that the stage is set for a roaring return in 2023 with some of the pieces already demonstrably in place.

The flaw in the digital asset sphere, and how it’s being corrected

Although the sphere has had its share of bad actors in the past, where 2022 was unique is how those bad actors rose to hold such high levels of esteem in the ecosystem before their actions were finally revealed. FTX, for example, had billions and billions in assets under management and had secured several sponsorships with secular markets in the process, which gave them significant cachet that allowed them to continue to build their empire until the mismanagement was finally revealed. Previously, incidents such as rug-pulls were thought to be limited to smaller sections of the industry, but now it is clear that there is no point where any entity should be considered trustworthy based merely on their size, history, or level of social or marketing acumen.

Although DeFi certainly has a role to play and the underpinnings of the market are quite sound, it is clear that adjustments need to be made to guard against bad actors, and increased regulation is one of the keys that will help restore trust. Some market players fear that increased regulation could negatively push down prices and opportunities, but it’s clear that if this increased regulation prevents even one more FTX-style meltdown, it will have paid for itself many times over. Already, we are seeing this take shape as the SEC has shut down a staking program on Kraken along with other actions taken against stablecoin issuers. And despite this, the price of Bitcoin rallied 14% over the same time period to trade above $25,000, along with other assets such as Ethereum seeing similar gains. It appears that while it’s entirely plausible that additional regulation could cause the market to take a haircut at the height of a bull run, it’s also equally true that not all markets behave the same and regulations could also potentially help ameliorate losses caused by incidents that we have witnessed over the past year.

The community also appears to be welcoming the increased scrutiny, and many see it as a potential benefit. Marketwatch reports cofounder of CoinRoutes Ian Weisberger stated that “It would have been 10 times worse had the SEC come out and asked Coinbase to delist all these coins saying, because they’re securities … I think people are realizing now that even the SEC knows that they can’t overstep because they would fear backlash, like they can’t go too far.” James Butterfill, the head of research at Coinshares concurred, stating, “The regulation rather than ban narrative is in some ways a positive outcome as it will help legitimize the crypto industry.” Although further crypto regulation may understandably be a tough pill to swallow, it also appears to be precisely what is needed at this point in time.

Where the market will go from here

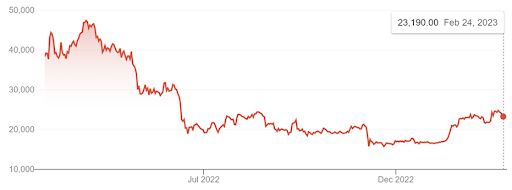

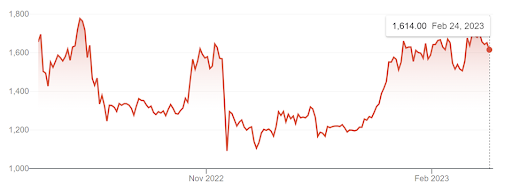

This is not the first “crypto winter” the market has seen, and it may not even be the last, but there has been a constant truth through all of them: the sun always rises. Crypto has weathered these kinds of situations before – everyone thought Mt. Gox would have been the end of digital assets in 2014 when the price dropped approximately 30% after the exchange went offline. Crypto has been “pronounced dead” more times than we can count since then, and yet here we are. Even at this juncture, we can already see the sun peeking over the horizon. Already Bitcoin has risen 32% of its price from its nadir at the point of the FTX collapse, and Ethereum has done even better, increasing nearly 50%. (Source: Google)

To build upon this market recovery, big players in the digital asset sphere will need to convey a sense of trust. After all, FTX was one of the movers and people affected by its disintegration would have a right to feel betrayed or slighted. In comparison, Coinbase reminded its customers that it held crime insurance to protect its assets in the case of theft or cyberattack, along with cash balances having FDIC protection. Binance also holds a Secure Asset Fund for Users (SAFU) that was recently “topped up” to $1 billion USD as of November 2022. These types of safeguards were conspicuously missing from FTX’s offerings, and as long as exchanges and custodians have measures in place to protect user assets from extenuating circumstances, then customers will feel safe using them.

Conclusion

With recent events still fresh in the mind, the digital asset markets are nonetheless beginning to make a strong turnaround. Between improved regulation and reassurance of asset providers to customers that their funds will still be safe even in the case of a catastrophe, that trust will be rebuilt and the market will continue to rebound.

If you have questions about our fund or would like to be sent investor documents, you can contact our investor relations department at [email protected].