State of Current Affairs for Digital Assets: Q1 2021

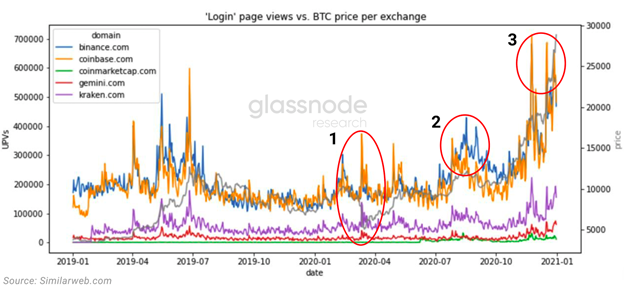

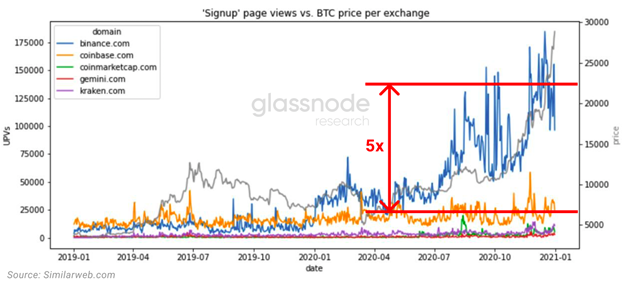

Bitcoin has reached several all-time highs in 2021, primarily driven by economic uncertainty in regard to the pandemic and concerns of inflation triggered by large amounts of economic stimulus. Initially, the push was driven by a large amount of institutional investment and greater accessibility of Bitcoin, such as with PayPal offering crypto trading to a massive and previously largely untapped user base. As time has passed and the bull run has continued, though, its tenor has changed. For example, Grayscale, one of the largest forces behind the institutional investment force has tapered off their purchase of coins, but this has been compensated for by a huge surge in retail investment. Over the past twelve months, Bitcoin holdings have increased on Binance by 38%, much of it occurring in 2021. Binance is also outpacing Coinbase signups by a factor of 5, as the sensational price highs have spurred a vast amount of activity and interest in Bitcoin.

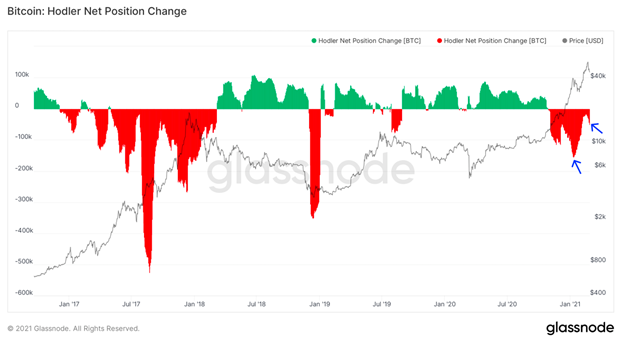

Morale is also extremely high, and sentiment appears to be that Bitcoin has not yet reached its price ceiling. Bitcoin holders are not shedding coins nearly at the rate that they did in previous pullbacks. Mike Novogratz, for example, believes that a $100k Bitcoin is in reach within 2021. Simon Peters of Etoro believes $70k is in reach. Scott Minerd of Guggenheim even believes that $400k to $600k may happen. Regardless of which quote hits its mark, it’s evident that this sentiment is based in real-life market action and is not just idle chatter. When the price dips and retail investment begins to wane, institutions buy and hold at that level, providing a stable base for retail to climb the next rung of the ladder. Institutions tend to be more ponderous, with lower appetite for risk and extremely deep pockets, while retail makes riskier, more agile plays, leading to a complementary system between the two groups.

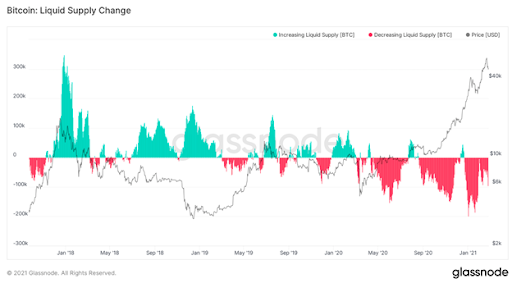

Further driving the price higher is the prospect of a potential supply squeeze. Bitcoin is being snapped up faster than it can be mined, especially with institutions purchasing thousands upon thousands of coins. The last year has seen a net decrease in supply with the lion’s share of it occurring in the last six months. While the halvening in May 2020 was likely a partial factor in the supply beginning to shrink, it does not fully explain the proportional difference in the gap, nor that the supply was already trending towards shrinking even before the event. The balance, then, must be driven by the healthy market fundamentals discussed earlier. Because institutions are more long-term gain oriented, their growing Bitcoin accumulation likely means they will not be selling later on, especially given the price ceiling ideas that are being discussed. It appears unlikely that there will be a large supply dump later on with the current understanding of the market.

Further institutional players are still entering the market, despite supply already being constrained. Asset management firm Stone Ridge has filed with the SEC to invest in Bitcoin, and its filing is expected to become effective April 26th. Stone Ridge founder Ross Stevens has previously described “a wall of money” coming into the asset class. A quote from the filing reads, “[The fund] seeks to generate returns by gaining exposure to the price of bitcoin by selling put options on bitcoin futures contracts. This strategy may also invest in pooled investment vehicles, such as registered or private funds, that themselves invest in bitcoin.” This would be one of the first forays of a mutual fund into Bitcoin, and may actually open the door for other mutual funds to follow suit now that the proof of concept is established.

Even institutions that were previously bearish on Bitcoin are now being enticed back by its recent success. Goldman Sachs had originally planned to open a Bitcoin trading desk in 2018, but mothballed the project citing regulatory concerns. Beginning in late March, they announced that they intend to re-open the desk and offer Bitcoin futures to its Global Markets segment, which represents its largest division by assets and revenue. Citigroup also released a statement in March describing Bitcoin as being at the “tipping point” and concluding, “There are a host of risks and obstacles that stand in the way of bitcoin progress. But weighing these potential hurdles against the opportunities leads to the conclusion that bitcoin is at a tipping point and we could be at the start of massive transformation of cryptocurrency into the mainstream.”

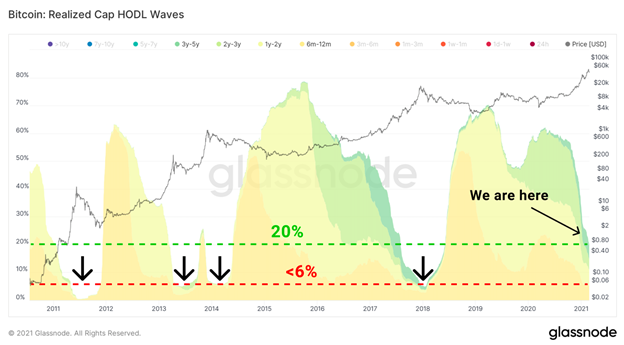

What should also be examined carefully, then, is the age of the bitcoin that is being moved. Short-term movements provide the bulk of the driving price, but such surges are rarely sustainable. However, it is evident that there is still room to grow. As of now, holdings older than six months only comprised an aggregate 6% of the realized market cap. History, however, indicates that this can extend as far as 20% before a major correction is experienced.

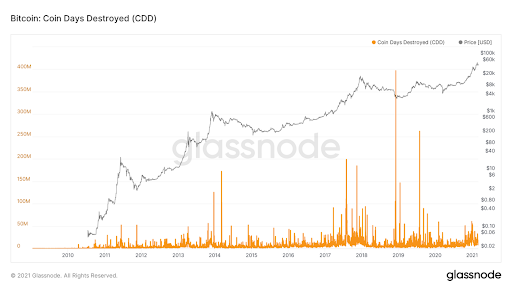

This dovetails with the fact that a significant amount of Bitcoin could potentially be lost, forgotten, or destroyed. Up to 18% of Bitcoin’s current supply has not moved for over seven years. While it’s probable that some level of this supply represents extremely long term holdings, looking at Glassnode’s Coin Days Destroyed statistic reveals heavy movement in 2018 and 2019 when some of these old coins had moved for the first time in many years, which has not been witnessed to the same extent in 2021, making it more probable that many of those older coins are truly gone. Institutions are competing for an increasingly smaller slice of the pie as they buy up coins faster than they can be mined. Bear in mind that institutional investors tend to have multi-year time horizons, and the next halvening is only a few years away.

What could be viewed as just a squeeze now is likely to turn into a crunch before long. In February, Tesla not only purchased $1.5 billion worth of Bitcoin, but also announced that it will accept it as payment for its vehicles, high-priced items in and of itself. This one purchase, by itself, accounted for over a month of newly minted bitcoin supply. This sparked a trading frenzy which pushed volume up 17% to $2.7 trillion. Institutions and large investors are racing to acquire Bitcoin, and FOMO is not only extending to potentially missing out on price gains, but whether Bitcoin can be acquired at all following the tightening supply.

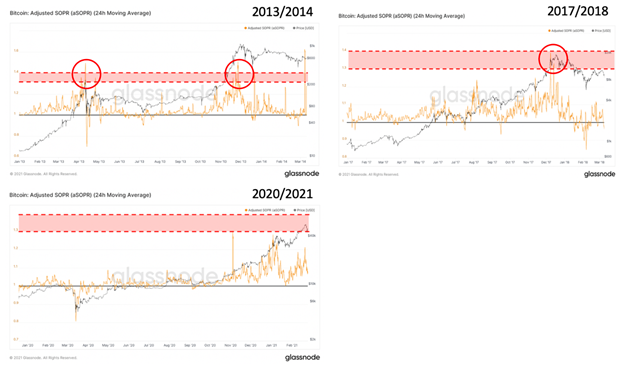

Consider also Glassnode’s aSOPR (Adjusted SOPR) metric, which filters out all transactions with a lifespan of less than an hour, which removes a great deal of noise from the transaction graph and provides a more accurate signal of sale or purchase transactions. Generally, market participants during a bull market will not sell below their buying price as they have an expectation that the price will rise in the future. Bull markets provide a clear signal when the market is due to take a turn, and that is the willingness of investors to disregard those expectations and start incurring short term losses. This phenomenon has been noted during all prior Bitcoin bull runs. Once it rises significantly above 1, then a market correction is not far behind.

Ethereum, the second highest asset by market cap, is not to be outdone. Although it is six years younger than Bitcoin, it has climbed the ladder and passed several altcoins that came before it to claim its current position. While Bitcoin was created with pseudonymous, borderless transactions in mind and has no doubt succeeded in this goal, Ethereum has taken it to the next level. As Bitcoin has grown, it has struggled with transaction overload. Bitcoin only processes 4.6 transactions per second, while Ethereum 1.0 already supports approximately 15 transactions per second. Vitalik Buterin, Ethereum’s creator, indicates that Ethereum 2.0 will support 100,000 per second. This represents a staggering amount of potential as these assets will have gone from lagging behind Visa’s average 1,700 transactions per second to surpassing it by orders of magnitude.

What has given Ethereum its muster is its scalability and greater number of use cases, one the most well-known of these being DeFi (Decentralized Finance), and it is only through the raw horsepower of this level of transaction processing that it can exist. Smart contracts, the main drivers of this paradigm, are self-executing contracts that trigger based when certain conditions of its code are met. This allows funds to be transmitted without the approval of a governing central authority, eliminating the possibility of any potential corruption or control by a human element. Decentralized exchanges, then, such as SushiSwap and Uniswap allow for peer-to-peer lending executed on these smart contracts between users, which can be done seamlessly between countries or across borders without middlemen or other interference.

Because of the lack of a governing authority, though, smart contracts must be airtight and written extremely carefully. On March 5th, Polkadot’s perpetual-future prices on Binance dropped by over 99% before regaining its price completely nearly instantly. However, in this brief time period, approximately $18 million of contracts had changed hands. The crash was caused by one user that put a single stop order which triggered the needle. Although the positions of other users were not impacted, it highlights the need for these contracts to be written with all possible failsafes needed to prevent technical errors or the potential exploitation of loopholes. However, because these problems can be worked around, and traditional banking systems have no answer as of yet to mimic such a decentralized systems, they are problems well worth overcoming.

Clearly, the market still has room to grow. With the sudden and massive surge of interest from institutional and retail investors alike, it clearly still has legs – and there are many compelling market indicators that suggest that this will proceed for some time. External factors to consider, though, are a potentially hastening end to the COVID pandemic in the United States, as the White House recently released guidance that all adults may have access to vaccines as soon as the end of May – which could potentially tug in the direction of a pullback as safe havens become a bit less needed. Nevertheless, the market at the moment is quite strong, with institutional and retail investors supporting each other, with significant positive sentiment regarding potential new all time highs, and strong market fundamentals giving it the strength it needs to go forward.

If you have questions about our fund or would like to be sent investor documents, you can contact our investor relations department at [email protected].