War of the Blockchains – Newcomers Struggle for Dominance to Meet Market Needs

With markets firmly in “Altcoin Season” territory as of this writing, all eyes have been on potential shortcomings of Ethereum at its current scale. With transaction times and fees on the rise and concerns over power usage and potential centralization growing, the community has been hard at work building solutions with alternative blockchains while maintaining Ethereum’s mission and structure. This has led to a crop of up-and-coming projects, all eager to fill the needs in the market left as Ethereum continues to mature.

Where Ethereum falls short

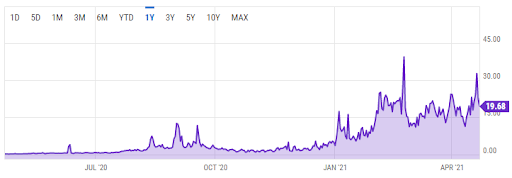

Challenges have risen with Ethereum as it continues to grow, such as the transaction cost growing from mere cents in 2020, all the way to $10 to $25 in 2021. The surging gas cost correlates with the bull run that ETH has experienced since the beginning of the year. Despite the recent pullback in all digital asset markets and the implementation of the Berlin fork on April 15th, transaction costs remain quite high as of this writing.

Source: YCharts

This stands to highlight challenges in the Ethereum transaction network and the tradeoffs that have to be made; it’s clear that demand for the network is not declining. However, the role of day-to-day transactions may very well be filled better by a competing network.

Enter competitors such as Binance Smart Chain (BSC). Using BSC as an example, its five-second block time is orders of magnitude faster than Ethereum’s five minutes with a transaction cost that only costs a few cents. BSC also allows the trading of assets such as ETH through “peggy coins” – tokens that are pegged to assets on their native chains. Not only does this represent a clear incentive to use the chain over the Ethereum native chain, but doing so will actually relieve transaction strain. One use case where this actually occurred was CryptoKitties, a game that allowed players to purchase, collect, breed, and sell virtual cats. The game was so popular that it significantly slowed transactions on the Ethereum native chain. Blockchains such as BSC also allow for the easier implementation of smart contracts and decentralized apps (DApps) that might otherwise slow to a crawl on native chains if they get too popular.

Potential disadvantages of BSC include more centralization than Ethereum, given that there are only twenty-one validators on the network at any given time, which theoretically could make the system more prone to system failures and regulation. Running a node is also complicated and requires more resources than simply setting up a miner, which decreases incentives for operators. Regardless, these are absolutely necessary tradeoffs that enable the advantages that a blockchain like BSC has over native chains, and demonstrate why alternative blockchains are needed.

Despite its disadvantages, BSC has proven enormously popular; according to data provided by EtherScan, Ethereum registered a new record of 1.56 million transactions on April 21st, but BSC registered a total transaction volume of 9.13 million. Avi Sanyal, head of trading at BlockTower Capital tweeted that ”New retail entrants are seemingly coming in straight to BSC/PancakeSwap through TrustWallet due to low fees.” It is clear that Ethereum demand is at an all-time high, which unfortunately has led to staggering gas prices, a problem that BSC has managed to work around quite clearly.

Where other blockchains can pick up the slack

Though Ethereum was written with decentralization as one of its core concepts, how that decentralization was incentivized has struggled with real-world economic pressure. The natural economic result is that mining will eventually settle in countries with the cheapest electricity, which hampers Ethereum’s original mission of decentralization. It is imperative that no single individual controls more than 50% of mining operations — and if 50% of hashing operations take place within the same country, that represents a potential vector for government control of the entire chain, even if different individuals are running the operations. Not only that, but the presence of ‘whales’ on a given chain that hold a large number of tokens can influence the overall market.

This potential vulnerability has spurred development of alternatives. Polkadot (DOT), for example, uses Nominated Proof of Stake for validation as opposed to the Proof of Work algorithm that Ethereum uses. Because mining power is allocated to the percentage of coins held by a miner, it allows anyone in the world to realistically participate in mining rather than the race to the bottom in search of the cheapest electricity prices. Polkadot also uses a governance system that allots voting rights based on the size of each individual’s stake in the chain. These advantages relieve DOT of much of the real-world economic pressures that Ethereum is presently facing.

Polygon (formerly Matic) has been developed as an answer to Ethereum’s scaling concerns. Polygon allows any developer to launch a blockchain network (or sidechain) with attributes set to their needs. One of the flaws of existing chains is that oftentimes developers have little control over the chain they’re working on, and have to work around or compromise to work within the bounds they’re given. Sidechains give developers a sandbox to work in where they can get back to focusing on the mission of their project, rather than spending time on compromising. Many other blockchains such as ZIL (Zilliqa) and Avalanche (AVAX) allow similar levels of control.

There is a great deal of optimism for Ethereum; the challenges presented are not insurmountable, and the high on-chain fees demonstrate an unabating level of demand as its popularity continues to soar. Innovative off-chain solutions such as BSC have also provided enormously popular solutions that allow trading to occur at a much cheaper price than on-chain. All of the components for Ethereum to soar even higher are in place, and the community has clearly demonstrated a strong level of support for the asset to succeed and work around its limitations.

What has given Ethereum its muster is its scalability and greater number of use cases, one the most well-known of these being DeFi (Decentralized Finance), and it is only through the raw horsepower of this level of transaction processing that it can exist. Smart contracts, the main drivers of this paradigm, are self-executing contracts that trigger based when certain conditions of its code are met. This allows funds to be transmitted without the approval of a governing central authority, eliminating the possibility of any potential corruption or control by a human element. Decentralized exchanges, then, such as SushiSwap and Uniswap allow for peer-to-peer lending executed on these smart contracts between users, which can be done seamlessly between countries or across borders without middlemen or other interference.

Because of the lack of a governing authority, though, smart contracts must be airtight and written extremely carefully. On March 5th, Polkadot’s perpetual-future prices on Binance dropped by over 99% before regaining its price completely nearly instantly. However, in this brief time period, approximately $18 million of contracts had changed hands. The crash was caused by one user that put a single stop order which triggered the needle. Although the positions of other users were not impacted, it highlights the need for these contracts to be written with all possible failsafes needed to prevent technical errors or the potential exploitation of loopholes. However, because these problems can be worked around, and traditional banking systems have no answer as of yet to mimic such a decentralized systems, they are problems well worth overcoming.

Conclusion

Clearly, the market still has room to grow. With the sudden and massive surge of interest from institutional and retail investors alike, it clearly still has legs – and there are many compelling market indicators that suggest that this will proceed for some time. External factors to consider, though, are a potentially hastening end to the COVID pandemic in the United States, as the White House recently released guidance that all adults may have access to vaccines as soon as the end of May – which could potentially tug in the direction of a pullback as safe havens become a bit less needed. Nevertheless, the market at the moment is quite strong, with institutional and retail investors supporting each other, with significant positive sentiment regarding potential new all time highs, and strong market fundamentals giving it the strength it needs to go forward.

If you have questions about our fund or would like to be sent investor documents, you can contact our investor relations department at [email protected].