Ethereum London Hard Fork Prepares to Go Live, Institutions Eye Proof-Of-Stake

On July 18th, 2021, the upgrade for Ethereum’s long-awaited London hard fork was deployed to its final testnet, with an estimated go-live date on August 4th. This move represents an important milestone in the progression towards Ethereum 2.0, which stands to be one of the most momentous advancements in the history of digital assets. The hard fork brings with it several immediate upgrades that may serve to provide several much-needed boosts as the sphere recovers from its sell-off over the past few months.

What the hard fork contains

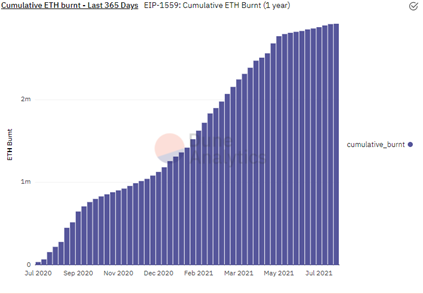

Five EIPs (Ethereum Improvement Proposals) are included in the upgrade, with two of them being particularly noteworthy. EIP-1559 will attempt to slow total ETH supply growth over time by burning a small, variable amount every time a transaction occurs. Part of the fee paid when sending ETH is also burned, which will also make it cheaper for end users. Unlike Bitcoin, Ethereum does not have a defined supply cap, and while EIP-1559 does not explicitly set one, it will still drastically curb the number of coins that are minted. Simulations indicated that had this change been implemented a year prior, it would have reduced ETH supply growth by 76%. Such a change will make it more viable as a store of value as it stymies the minting of new coins.

Other changes in EIP-1559 set a specific base fee for transactions to be included, and the option to include an additional “inclusion fee” – essentially a tip for miners to prioritize a transaction. Overall, this will not only speed up the network as a whole, but also make transaction fees more predictable during high volatility periods.

EIP-1559 has been well-received by most involved with the network, with the exception of miners; however, another proposal EIP-3554 delays the “difficulty bomb” that will incrementally increase the difficulty of mining on the network to December 2021. The goal of this is to freeze the proof-of-work algorithm to prepare for the eventual changeover to proof-of-stake where rewards will be given based on held assets rather than performing mathematical calculations. Though currently contested by individuals involved in the network, proof-of-stake represents an important paradigm shift in digital assets as a whole, as it removes a contentious leg of opposition from the more secular world over electricity use and potential effects on climate change. It also gives a level of insight into when Ethereum 2.0 will eventually launch, as it is very unlikely for 2.0 to launch before the difficulty bomb comes into effect.

EIP-3675 launches on GitHub, putting ink to paper for the Ethereum 2.0 Merge

On July 22, 2021, a pull request for EIP-3675 was created, which represented the first formal proposal for the Ethereum 2.0 merge. Although caution should be taken that it is very unlikely to occur in 2021, the EIP noted that, “The long period of running without failures demonstrates the sustainability of the beacon chain system and witnesses its readiness to start driving and become a security provider for the Ethereum Mainnet.”

Even the slightest bit of news on Ethereum 2.0 generates a great deal of positive sentiment, and for good reason; it is likely to be one of the most momentous innovations in digital assets since the launch of Bitcoin. Many concerns about Bitcoin that have grown over time could not have been predicted when it was originally designed, as no one could have known the scale it would have grown to where those issues would have finally manifested. With the shift away from proof-of-work mining and a focus on transaction throughput, speed, and cost, Ethereum 2.0 is an ambitious project that aims to bring the transacting power, security, and low cost that Bitcoin had in its infancy to a market scaled to the level that it currently resides at.

Institutions in some countries have begun taking notice of the proof-of-stake algorithm that 2.0 operates under and are already getting on board as it meshes well with their own set of offerings. Staking is already available for 2.0 many on coin exchanges, though nothing can be withdrawn until 2.0 officially launches. Switzerland’s Sygnum Bank is one of the first to offer staking to its clients as of earlier this month, and competitor SEBA Bank has already announced plans to follow suit. JP Morgan has also spoken positively about digital asset staking this month, suggesting in a report this month that Ethereum is bringing staking into the forefront and that staking might even grow to a $40 billion industry by 2025; the report further noted that “As staking becomes more commonplace, we think it could drive the interest and market capitalization of proof-of-stake cryptocurrencies higher… Not only does staking lower the opportunity cost of holding cryptocurrencies versus other asset classes, but in many cases cryptocurrencies pay a significant nominal and real yield.”

As of now, there is already $12 billion locked up in the Ethereum 2.0 staking contract, generating an APR of about 6%. Most current offerings range between 6% and 8.5% return per year, which means even should the asset’s value decline modestly over the year it could still be a more attractive option compared to a legacy savings account. If this trend continues, Ethereum staking could very well supplant the dismal returns that savings accounts currently provide, which very frequently fail to even crack 1% per year and are also subject to change depending on economic conditions.

Conclusion

The Ethereum 2.0 development cycle has been running for a number of years now, and now that the rubber is meeting the road it has begun to generate significant hype. 2.0 going live is likely to be a seismic event on par with Bitcoin halvenings, and investors are already putting their money where their mouth is given that $12 billion is already locked up in the staking contract even though it cannot be withdrawn until the official launch. It also represents the largest movement within digital assets to learn from the past, as it has new, innovative answers to many criticisms facing Bitcoin and other current assets.

If you have questions about our fund or would like to be sent investor documents, you can contact our investor relations department at [email protected].