High Tide in the Non-Fungible Token Marketplace

Non-fungible tokens (NFTs) shot out of the gate in February 2021, and while they were initially dismissed as a fad, they have shown incredible staying power and continued growth as the year has progressed. While the most well-known uses for NFTs are for digital art, such as when Beeple sold a piece for $69m, the marketplace has so much more to offer and has managed to fill several new market needs in the process.

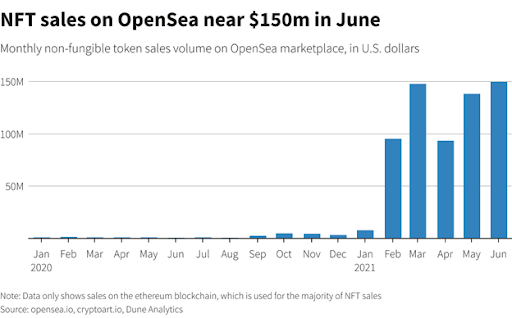

OpenSea Posts Meteoric Sales Numbers in Q1 to Q2 2021

OpenSea was founded in 2017 to facilitate the sales of non-fungible tokens, but came into its own after interest in NFTs exploded in the digital asset market. After facilitating $24m in cumulative volume in 2020, 2021 has already seen over $1b of transactions occur on the platform, with $174m occurring over the past 30 days.

Having recently completed its Series B funding round for $100m, OpenSea announced that it would expand its cross-blockchain support and begin supporting the Polygon blockchain. The funding round’s completion increases the startup’s valuation to $1.5 billion, and the round led by Andreessen Horowitz also included participation from Michael Ovitz, Kevin Hartz, Dylan Field, Kevin Durant, Ashton Kutcher, and Tobi Lutke. Smaller rounds for other NFT marketplaces had also been announced, including $20m raised by Enjin in a token sale for Efinity and $14m raised for Rarible, which will support the Polkadot and Flow blockchains, respectively. Mintable, backed by Mark Cuban, also raised $13m in Series A funding, and even beyond OpenSea it appears evident that investors and venture capital firms are bullish on NFTs being around for the foreseeable future.

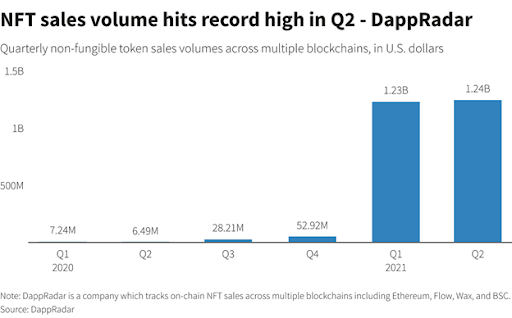

Beyond OpenSea, the market at large is also showing meteoric sales numbers. After posting less than $100m for the entirety of 2020, overall sales have already reached nearly $2.5b for the first two quarters alone in 2021, and this includes only on-chain transactions. After considering that there are also an unknown number of off-chain transactions not included in the data (such as those that occur at auction houses) the numbers grow even more impressive.

What’s Driving the NFT Craze?

Although the market is still adjusting to the current growth and there is undoubtedly a fair bit of speculation, the use case of NFTs was described by OpenSea CTO and co-founder Alex Atallah: “People understand that this idea of a unique digital object that you can own in your wallet, and trade around freely is cool and exciting. Recently there’s been a big uptake in these collectible art projects where there’s some scarcity associated with the items or maybe there’s a game associated with them. It’s captured the imagination of a broader group of consumers.” NFTs allow users to possess an unique item digitally; although it can certainly be copied and transmitted by others, only the token holder possesses the unique identifier to hold the original in their wallet. This allows individuals to retain the cachet of holding the original copy of the digital artwork, similar to how physical art collectors might desire to hold and display the original of a widely reproduced piece of work.

It’s not just artwork that can be stored in an NFT, though – anything that can be represented as a file on a computer can be stored in one. Computer scientist and principal mind behind the World Wide Web Tim Berners-Lee placed his source code from 1989 up for auction as an NFT, which sold for $5.4 million. Such an auction reveals a need to fill in the collecting world for abstract objects that are difficult to substantiate in a physical form; after all, it can be difficult to represent the 9,500 lines of code involved in the real world, and such an item seems uniquely suited to the NFT format.

NFTs have myriad further uses as well, including licenses and certifications, gaming elements or items, land or other objects within virtual worlds, and ownership verification of physical items such luxury items and accessories. Items that previously needed a physical certificate of authenticity that could potentially be lost or destroyed now have the option of a permanent online blockchain-based verification, and systems such as QR codes could be implemented to help verify that authenticity via a common smartphone. It could also allow prospective buyers to view the owner history of an item, as well as purchase prices, instead of just relying on the word of the seller.

The NBA is one of the largest American organizations that has officially gotten on the NFT train, having launched NBA Top Shot, an NFT marketplace facilitating the trade of sports highlights and other basketball-related digital assets. Individual items have fetched incredible prices, such as a LeBron James highlight selling for $200,000. The price of entry is quite low, costing only $9 for a “pack” of digital items, evoking memories of basketball cards that were extremely popular prior to the turn of the century. As of May, over $700 million has been traded on the marketplace between a million active users, even as the platform exhibited growing pains by selling out of item packs faster than they could be created. Despite showing impressive figures for desirable items, Top Shot is also extremely accessible to the market at large; CEO Roham Gharegozlou indicated that out of the 4.5 million transactions over the prior quarter, over 3 million had been for less than $50.

Conclusion

NFTs have demonstrated a high level of utility through the sale of not only art, but also luxury items, digital sports memorabilia, and software code. With the market continuing to post strong overall sales numbers and new marketplaces receiving venture capital interest, it’s evident that the train still has a lot of steam to move forward. Innovation in the market has also captured the interest of large sporting organizations such as the NBA and it’s quite possible that others may see the possibility and follow suit.

If you have questions about our fund or would like to be sent investor documents, you can contact our investor relations department at [email protected].