Sunrise in Digital Asset Market Following Sell-Offs

The digital asset market has been on a wild ride downwards over the past few months, attributed to negative sentiment from a few particularly large market movers and concerns of crackdowns over trading and mining in China, which had previously held the lion’s share of the network’s mining operations. Much of the prevailing sentiment has called this a repeat of 2018, but there are strong indicators that long-term oriented market movers are scooping up coins at a massive discount. .

Fear driving recent sell-offs, not fundamentals

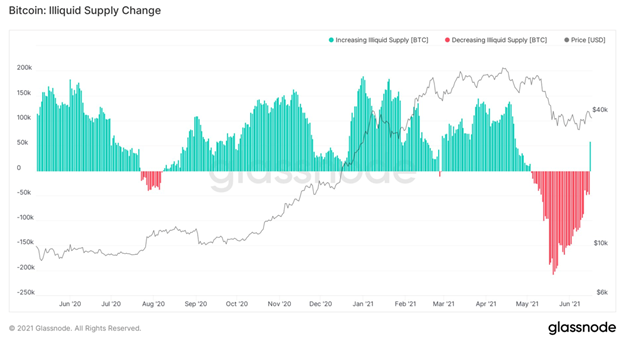

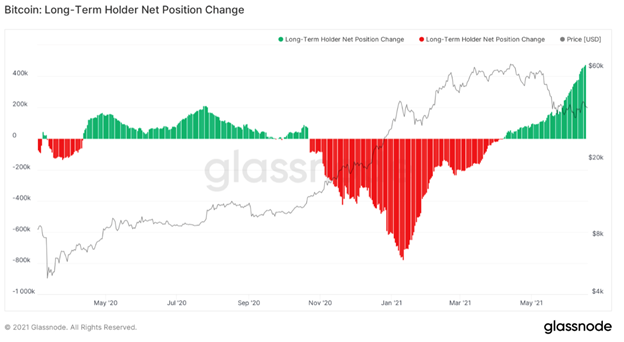

What’s important to realize is that although the price has bounced around $32,000 to $37,000 for a few weeks now, there have been positive market rumblings that a cursory price examination would miss. The market is not merely spinning its wheels, but rather long term buyers are finally beginning to get the better of short term sellers. Illiquid supply change has flipped back to a bullish signal for the first time since the selloff. Alongside this, long-term holders have increased their position over short term sellers to the tune of $186 million USD over the past seven days. This is a signal that the strongest hands have finally unpacked the flurry of negative news in its entirety, and have decided to begin accumulating again. What may appear less bullish is that the number of whales entering the market is also trending downwards. However, the fact that we are beginning to see big movements in these indicators despite lukewarm institutional support is extremely encouraging, as it is healthier for the network as a whole to have holdings distributed over more hands.

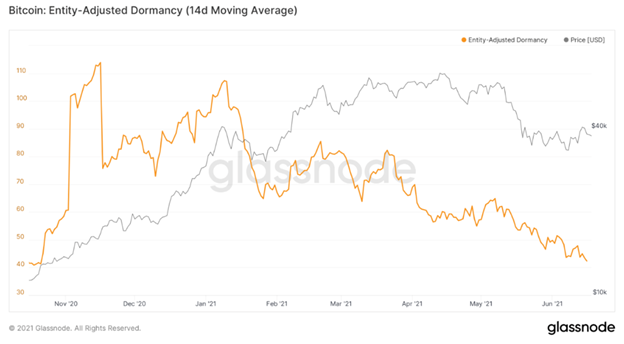

Additionally, note that holdings continue to transfer to more long-term investors; dormancy trending down refers to shorter-term positions being sold. This has been a trend for several months, but despite the price struggling, coins continue to move into longer-term holdings, which may explain the tug-of-war-like price behavior over the past few weeks. The shorter-term holders continued to liquidate, only to be snapped up by longer-term holders looking for a discount. Judging from the two metrics above, it appears to be a battle that the longer-term holders appear to be gaining the upper hand in. This is behavior that has been witnessed following prior peaks as well; the market has a knack for sniffing out undervaluing. Right now, most of the upward resistance holds out at about the $41,000 level, where the 200-day moving average stands. If this can be broken through attrition as more long-term attention is attracted to Bitcoin, it could lead to further price recovery.

Inflation is starting to reach concerning levels, and certain industries are starting to simply pass that cost along to consumers. Inflation picked up to 5% in May, and in that same month, prices for food away from home rose 4% in May from a year prior, the biggest jump since May 2009. Bitcoin is once again looking like a promising hedge against it, and this could also be reflected in price rallies in the coming months. More money is being printed than ever before, and the 2024 Bitcoin halving is still creeping ever closer, month by month. For long-term minded individuals with a horizon involving the halving, this may be the best – and perhaps the last opportunity to pick up bitcoin at this level before it occurs..

The digital asset market is wider than just China

Votes of confidence have been expressed in Bitcoin despite China’s crackdown. In early June, El Salvador president Nayin Bukele announced that Bitcoin will become legal tender as of September 7, 2021 through a partnership with digital wallet company Strike. Following the announcement, Athena Bitcoin announced that they plan to install approximately 1,500 Bitcoin ATMs in the country, focusing on areas where citizens receive funds from abroad to avoid high commission costs. El Salvador represents a perfect use case for Bitcoin, as World Bank data shows monetary transfers to the country made up nearly a fifth of its GDP in 2019, representing one of the highest ratios in the world. Politicians in other South American countries have also expressed support, with Paraguay congressman Carlos Rejala hopes to pass a bill aimed to encourage digital asset companies to the country, with further plans to follow El Salvador’s lead in making Bitcoin legal tender should it pass. Argentinian politician Francisco Sanchez tweeted a photo of himself on June 7th with red “laser eyes,” a recently adopted meme among Bitcoin proponents.

The Chinese ban has also rejuvenated interest in mining operations in countries that had previously been priced out of the industry, which will distribute them over more countries. This may be a blessing in disguise, given that China may have controlled up to three-quarters of all hashing prior to the ban. It is also an exhortation to avoid consolidating too much mining power in any one country, as it was previously predicted many times that without sufficient democratization one nation can hold undue sway over the market. It appears that this is a wakeup call to the community, and miners are now finally returning to countries they had once forsaken.

Initially, the United States was one of the first countries to be priced out of mining operations but now the state of Texas may become a haven for miners. With the cheapest electricity in the country, an increasing focus on wind and solar, a deregulated power grid, and libertarian political leaders, it represents fertile ground for new mining operations to spring up once again in the US with an influx of cheap mining equipment on the market, while also being free of the political baggage of using nonrenewable resources to power mining.

Conclusion

Much as in 2018 and prior, the digital asset market provides reason for optimism rooted in market fundamentals. It appears that at this point Bitcoin is very much oversold, and long-term investors do not appear keen to let the market drop further and are finally outpacing weaker hands. Countries beyond China also continue to express confidence in Bitcoin, which will hopefully represent a shift back towards a greater geographical distribution rather than mining simply flocking to the path of least monetary resistance.

If you have questions about our fund or would like to be sent investor documents, you can contact our investor relations department at [email protected].