Financial Endowments Vigorously Pursue Digital Assets

Institutional Money Finds its Way In

Digital assets continue to forge new avenues into financial and investment markets. The latest sign is large institutions beginning to treat them with the attention they deserve. Many private companies in the US have already implemented blockchain as a method of improving their offerings or internal processes, but institutional investors have now demonstrated an interest in digital assets strictly as a method of earning returns. They have taken a particular interest in Bitcoin; not only because of the longevity the asset has demonstrated, but also the continued healthy, organic growth that has pushed the environment forward, even during market downturns. The diligent work that developers and participants have put into the space has not gone unnoticed.

Forward Thinking Investments Pay Off

To date, endowments have generally been quiet with their affiliations with digital assets. Prior to 2018, Harvard University was the only large United States endowment investor with a stake in the space; still quite notable, given that their $39.2 billion fund is easily the largest university endowment in the world. In 2018, Stanford, MIT, and Yale followed suit and made their own investments into digital asset funds. Only now has it become evident just how widespread institutional money has become invested.

Earlier this year, the TRADE Crypto service published a report that revealed a staggering 94% of 150 surveyed endowments revealed that they have some level of investment in digital assets. Of these positive respondents, over half stated that it represented a direct, deliberate investment in individual assets, while the remainder gained exposure indirectly through various funds. While many of the respondents acknowledged some level of concern regarding growing pains in the space, the general tone evoked both excitement and cautious optimism. The investment strategy of endowments tends to be long-term, and often with more of a focus on alternative assets than other institutions. Given the meteoric overall rise in value for Bitcoin over time since its founding, it is a prime asset for a long-term focused institution to take an interest in.

The biggest concerns that respondents described included infrastructure, volatility, regulatory concerns, and liquidity. This makes sense, given the cautious overall nature of endowment funds. The top requirement that endowments sought was a greater focus on both enforcing existing regulation and adding new regulation. Following that, endowments were most concerned with capital flow and account security. Only 7% of respondents were considering lowering their digital asset investments over the coming year. 55% projected an increase, and 38% expected their level of involvement to stay the same.

Why Digital Assets Are So Compelling

Mike Novogratz, CEO of investment bank Galaxy Digital gave his thoughts on institutional money in digital assets: “Put this in perspective. Ethereum is four years old. What I think 2017 did, that crazy bull market, is it gave people unrealistic expectations on how fast the blockchain revolution, the crypto revolution, is actually going to happen. Bitcoin itself found a niche case and that’s why it’s outperforming, and why I think it will continue to outperform. It’s kind of a finished product, but the rest of the crypto revolution is five or six years away from really impacting your everyday life.” It makes sense that the endowments focused specifically on Bitcoin. While different assets confer their own technical advantages and disadvantages, when looking to enter a new market, a concerted, focused effort is needed. Bitcoin’s length of history, unparalleled level of community involvement, and market penetration make it the ideal candidate for consideration. Even when the market went through its characteristic heavy swings, participation, interest, and development in the space continued as usual even in bear markets. More than anything, this helped dispel the notion that Bitcoin was a “get rich quick” scheme or a financial game of musical chairs. Had that been the case, the space would have risked shriveling up and disappearing every time the market swung downwards; and yet, after all this time, it remains strong and continuing to grow.

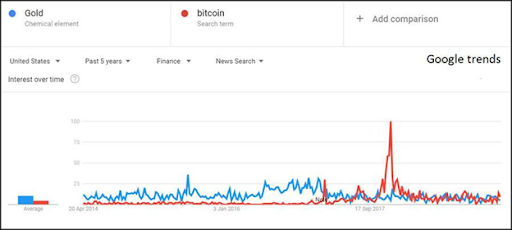

Bitcoin is also developing serious cachet among institutions as an alternative investment to stabilize portfolios as recession concerns grow. Only this year, Forbes wrote an article entitled “Bitcoin is the New Gold” describing how Bitcoin’s limited and fixed currency minting allows it to act as a stable container for value. Gold has long been viewed as the consummate safe haven for investors during turbulent markets, and the thought of a digital asset being capable of functioning on such an esteemed level would have been viewed as preposterous even just a few years prior. The long term picture, though, shows interest in Bitcoin taking a quite noticeable chunk of attention away from gold, most markedly over the last few years.

This newfound status derives from the level of community involvement and its steadfast desire to prove that Bitcoin was more than just day traders circling each other looking for an opening to make money. For the past ten years, it has fought a daily battle to prove that it was a viable currency that could disrupt the status quo, and such a resounding demonstration of acceptance among cautious, long-term investors shows that it has reached that well-deserved level of status. It is only a matter of time before other maturing digital assets will follow suit.

Furthermore, institutions desire regulation and transparency. The original ‘wild west’ atmosphere that Bitcoin was birthed in, for better or worse, is not an appropriate environment for institutional money. The concern of potential SEC action would most certainly have stymied any possible interest, especially when the market was so undefined and unregulated compared to now. Now that global financial centers are developing their own roadmaps for digital asset investment regulation and the US is following suit, institutions are right to feel more secure about them as a viable option.

Conclusion

Endowments have warmed up to digital assets in a truly overwhelming show of support. It is a sign that they have reached a level of maturity that would have been unthinkable even a few years prior. Bitcoin’s diligent growth and focus on development has helped it become worthy of some of the largest players in the investment market and its acceptance shows that other assets, in time, will be worthy of the same attention.

If you have questions about our fund or would like to be sent investor documents, you can contact our investor relations department at [email protected].