Bakkt’s Flopped Launch Exhibits Negative Market Sentiment.. or Does It?

The State of the Bitcoin Market

The prior few months have exhibited market indicators that could be viewed as concerning for digital assets across the board – most notably Bitcoin, which is viewed as the flagship asset, due to its length of history and level of utilization. Although trading prices are not terribly far off from their recent peaks and represent quite a healthy gain over the past several months, trading volume has appeared to become chilled as a result of wider market news. Despite this, several bright spots remain and a breakdown of what’s happening will show the best way forward and how to put these indicators into wider context.

Bakkt’s Rocky Start Hints at the Root of the Concerns

The widely-anticipated launch of asset exchange Bakkt failed to meet expectations, defined by many media reports as “lackluster”, “limp”, and “anemic”. In its first 24 hours of operation, only 73 contracts for 1 bitcoin each were traded on the platform; compare this to CME Group’s exchange launch in 2017 which traded 751 contracts worth 5 bitcoins each. In fact, Bakkt’s first contract didn’t even trade until the exchange had been live for 18 hours. There may have been an explanation for this, however, and it may simply have been poor market happenstance at the time of the launch.

On the day of Bakkt’s launch, Bitcoin prices had dropped from $10,000 to $8,350. It is thoroughly unlikely that the launch of the exchange was the reason for such a precipitous drop in price since the asset ecosystem is much larger than just a single exchange. It stands to reason, then, that investors would be wary about making a large investment in futures during the exact moment a market downswing is occurring. It should be made clear that despite the further drop afterward, the asset’s price is still holding a considerable amount of its gains over the prior year.

Bitcoin Prices (Past Year) (Source: Coinbase)

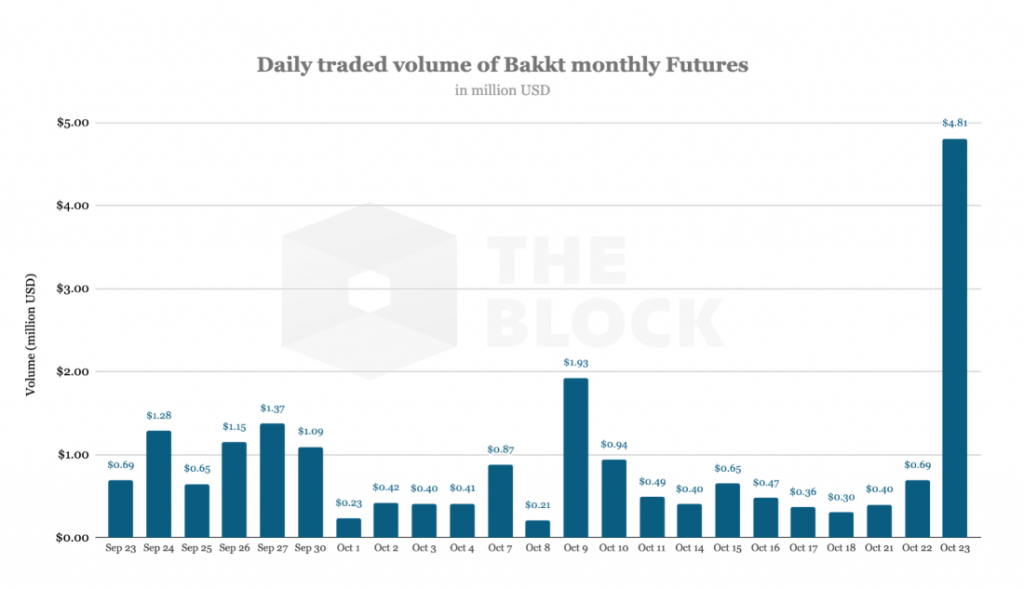

Once investors had time to ruminate over the price drop, however, Bakkt astonished the sector with a record jump in volume. On October 23 after the further sudden price turbulence, Bakkt’s volume had surged five times past its original forecast after two hours. This represented its single largest volume day since its launch. Prior to this day, the daily all-time high for Bakkt was reached on October 9 with a peak of 224 BTC. This volume surge seems to have carried over into the following day; on October 24th, positive momentum was maintained with a volume of 347 BTC. There is clearly interest in using the platform, so two questions remain: was Bakkt’s disappointing initial volume a reflection of the market at large, or merely investors attempting to draw a conclusion over insufficient sample size? And secondly, why did only the second, smaller price drop trigger a volume surge?

The Context of Larger Market Conditions

Critics calling for another spell of doom and gloom for the digital asset community may once again have a short-sighted view. It is true that Bakkt is not alone with low trading volume concerns. Other exchanges have reported their own drops in trading volume, such as LocalBitcoins shedding 30% of its volume over the past month. However, these variables must be considered in context – how are other factors performing?

Firstly, the volume surge in Bakkt after the second price drop seems to indicate that a price floor has been reached, which is certainly a sign of good market health. As of this writing, the trading volume appears to be holding strong at the current price point. More data is needed before a firm conclusion can be drawn, but there is reason to be cautiously optimistic that the price will hold if the sheer night-and-day contrast of trading volume between the two drops is any indication. It should be noted that despite these drops, Bitcoin over 2019 is still the best-performing asset, still outperforming tech stocks even during a lengthened economic bull run. Even if the asset fell even further, it still has room to brag about strong returns – so while the price drop seems scary, it appears much more like a correction than a crash.

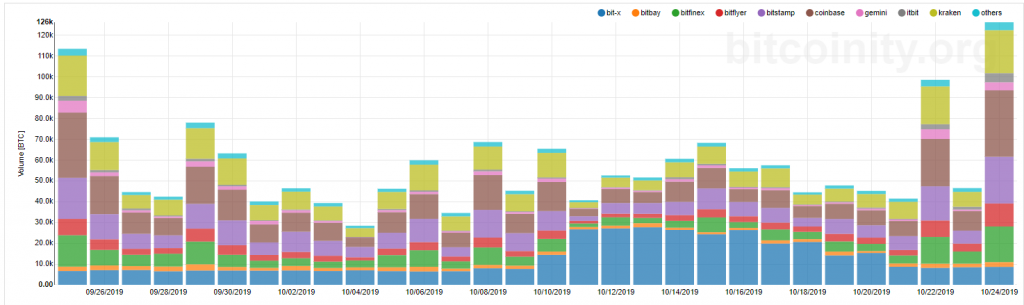

Overall trading volume prior after the drop on October 7 appears to be in a subtle uptick as well. While the difference is not stark, there is a noticeable shift in that daily volumes appear more robust, with generally higher floors, higher ceilings, and less variation from day to day. Those discomforted by the price drop can feel safe that the fallen price has been tested and then shored up by positive variables found elsewhere. Market sentiment appears to show great concern over the price falling, then the volume falling in turn; but it appears that the falling price has actually spurred traders into action and increased the volume. As long as one variable supports the other, that is a sign of an ultimately healthy market.

Trading Volume (Past 30 Days) (Source: Bitcoinity)

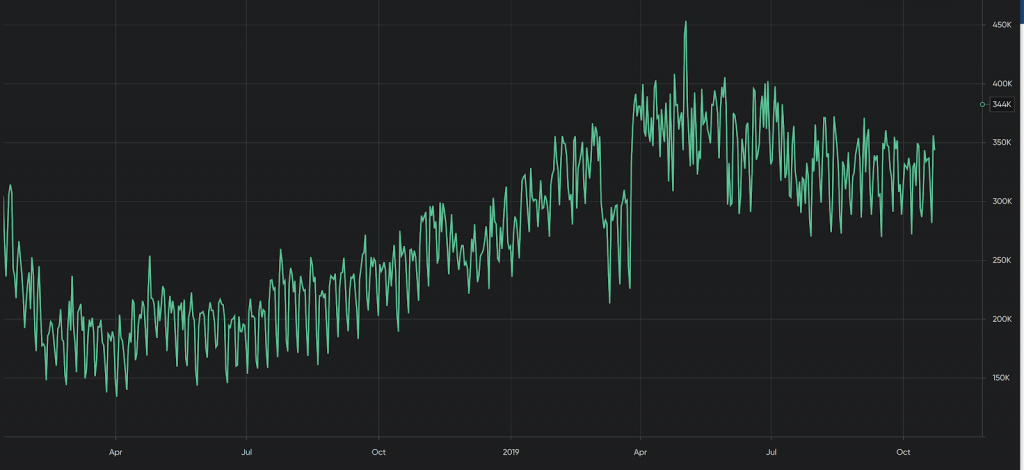

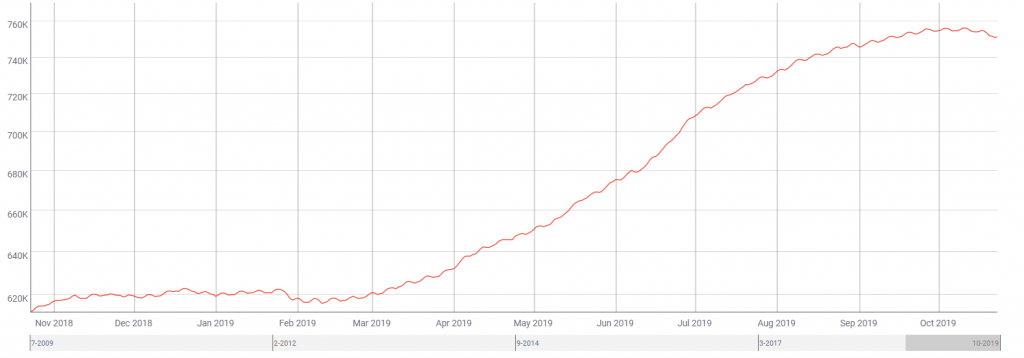

Looking at network factors beyond trading, it appears it is simply business as usual on the Bitcoin network. The number of daily transactions as well as the number of unique addresses are fairly trending upwards over the prior two years and does not appear to have been affected by the price swings. It is always important to consider factors beyond the exchanges when considering the overall health of the ecosystem, and it appears utilization of the network is as strong as ever.

Daily Transactions (2018 – 2019) (Source: Bitcoin.com)

Active Daily Addresses (2018 – 2019) (Source: coinmetrics.io)

Conclusion

Many recent articles with negative sentiment recently tended to focus on just one aspect of the market’s performance, which is an unfair and short-sighted method of examining conditions. Volume decreasing as the market approaches its perceived peak is natural rather than a sign of poor health. Had price and volume fallen together, concern would be much more warranted, but the data provided above shows that this is not the case.

To sum up everything just described, while it is true that the market overall has fallen from its recent peak, there is more than enough evidence to state with confidence that a 2017-style crash is not in the cards. There appears to be a strong level of resistance at the current price point, as evidenced by increased trading volume once Bitcoin price stabilized. Furthermore, network utilization does not appear to have been impacted, so the fundamental interest and underlying use case for digital assets remain strong.

If you have questions about our fund or would like to be sent investor documents, you can contact our investor relations department at [email protected].