The Metaverse Takes Hold

Facebook’s impending “Meta” rebrand has sparked interest and discussion about the “Metaverse” – a collection of highly customizable 3D worlds that focus on individual governance and digital asset economies with business, education, and retail applications. Though the Metaverse is still in its infancy, many prior and current use cases of online worlds with real-money transactions suggest that there is huge market potential for these online communities as their learning curves flatten and the products grow more flexible. The Metaverse saw an initial big spike in users in 2020 due to economies shifting online due to the pandemic – and a year later, it does not appear that they have any plans to leave.

The History of Online Worlds

There is precedent for what the Metaverse is looking to accomplish, and it goes back further than one might think. Second Life by Linden Lab launched in 2003, which held a flexible, fully realized 3D world that allowed users to own virtual land and create and sell items for virtual currency, which could then be exchanged for real life money. The creator announced that in 2005 its game economy had generated $3.5 million of economic activity in 2005, and in 2006 an effective GDP of $64 million was reported. At the game’s ten year anniversary, $3.2 billion in transactions had occurred.

Within the growing Metaverse, the ante has been considerably raised. Newer applications such as VRChat, Horizon Worlds and Sandbox have followed in Second Life’s footsteps, and have made the player on-boarding and object creation process more user-friendly, leading to widespread adoption over the intervening decade. A plot of digital land in Decentraland recently sold for $2.43 million of “mana” (the digital asset the platform runs on) which outpaces the average home prices in Manhattan and San Francisco.

The use of the Metaverse has expanded from hobbyists into business, with Microsoft integrating 3D avatars and immersive meetings into Teams. With work becoming more and more distributed geographically and home offices becoming more common, it allows participants to create an avatar for themselves that more accurately fits their self-image, leading to enhanced meeting participation, especially for those that are uncomfortable seeing themselves on camera, or for those who find social cues in video meetings difficult to follow. It also allows operations to continue in adverse situations where meeting in person is not possible, and saw extensive use during the early stages of the COVID pandemic.

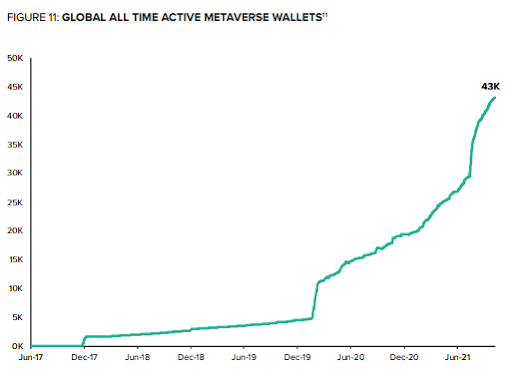

Overall, initial interest in the Metaverse appears to be picking up steam; at the beginning of 2020 the virtual worlds had nearly 50,000 all-time users, up nearly ten times over. Should the growth rates remain what they are, the Metaverse could very well become a mainstream player before very long. It stands to reason that if this was a one-off driven by the black swan event that was the pandemic, then a huge chunk of those users would have left by now.

Source: Grayscale

Where Digital Assets Come In

Investment firm Grayscale appears to be very bullish on the Metaverse, and released a report this month in which they indicated that there may be a market worth $1 trillion residing in virtual cloud economies — with the bulk of it focused on social and gaming, which could represent $400 billion of the total pie by 2025. The space is growing big enough to compete with Web 2.0 companies which comprise approximately $15 trillion in market value. A big part of this opportunity is that many companies currently operating online games do not allow players to monetize their assets or time investment into the game; in fact, many current game proprietors such as Blizzard ban users that are found to have exchanged real life currency for game assets.

A foray into allowing a company-sanctioned “Real Money Auction House” in Blizzard’s Diablo that did allow users to sell game assets for real life money proved short lived, as it was disabled without explanation upon the release of the game’s first expansion, despite the apparent popularity of the feature. Despite this, there is a tremendous black market for trading real life currency for game items, which plays off the axiom of time being money – the highest level of content in these games often requires the use of consumables and other preparation to maximize player performance. Individuals that purchase game currency cite that spending real life money to pass this hurdle allows them to focus their efforts on the content they truly want to consume.

It is evident that the line between work and play is blurring as well, as players that are willing to “farm” in-game objects are also looking to be compensated for the fruits of their in-game labors. Observed in-game activities have included the use of custom blockchain-based payments methods such as MANA or SAND, or utilizing the platform they’re built on such as ETH. Players can also purchase NFT items from others and bring them into virtual worlds to be put on display or sold, or rent or lease virtual land or items to receive a return on investment.

Grayscale also commented that further monetization within the Metaverse would also be possible, especially with events that mimic real life events such as virtual casinos, billboards, and live music. Some firms such as Binance have established digital headquarters in the Metaverse where employees can meet and collaborate, and other companies such as Atari have opted to create sponsored content, such as an arcade that features games that can be played within Decentraland.

Conclusion

There has been clear, demonstrated demand for online, highly customizable spaces to build worlds in for decades now, but due to technical limitations and the lack of real world applicability they have not taken off into billion-dollar enterprises. That all seems set to potentially change as interest in the Metaverse takes hold. Many Web 2.0 companies place strict control over their in game resources and currency, to “keep them in the Matrix” as it were – but now, the Metaverse is showing what can be accomplished by the creativity of its users now that that loop has been broken out of.

If you have questions about our fund or would like to be sent investor documents, you can contact our investor relations department at [email protected].