Fintech Offerings Outpace Legacy Institutions

In recent years, traditional banking institutions have struggled with meeting the needs of their customer base. With a great reliance on legacy processes that have not changed appreciably in decades, the need for innovation has never been greater. Fintech offerings have sidestepped many of the slow mechanisms that have hamstrung traditional financial system development, and their influence is beginning to eat into the market share legacy banks had previously enjoyed without competition.

How fintech apps ate the lunch of legacy systems

Over the past ten years, the demand for digital wallets has grown and become the Achilles’ heel of legacy banking operators. As of now, traditional banks essentially demand that you play by their rules, or not at all. Transferring funds between private parties, while certainly possible, is still a cumbersome affair and has not evolved much in the intervening years. Unless both parties have the same bank, options are limited to physical checks or ACH transfers that require days to clear, expensive wire transfers, or third-party, cumbersome wrappers like Zelle to move money between accounts.

When PayPal launched in 1999, it became the first digital wallet that gave users instant access to their funds. Though it still took time to move funds back to a bank account, for the first time a user could receive proceeds from an eBay auction sale and then swipe their debit card to buy lunch with those funds mere minutes later. Though pedestrian by today’s standards, it’s still a use case that traditional banks have no real answer for twenty years later; until the money enters the ‘walled garden’ of your bank account through a nightly clearing process, it is not yours to spend. Even beyond this, digital wallets have grown to include other services, such as holding stocks or digital assets, driver’s licenses, or tickets for entertainment events. Services such as Square and Stripe allow vendors to swipe cards and accept funds for products and services in person by just attaching a dongle to their mobile phone. With services such as PayPal also increasingly offering digital asset solutions, they have found a way to further sidestep slow legacy banking operations. A PayPal user can now purchase cryptocurrency using his PayPal balance, and send that money to another individual’s blockchain wallet even if they don’t have a digital wallet on the same service. Simply put, Fintech has responded to user demand in ways that traditional banks have failed to.

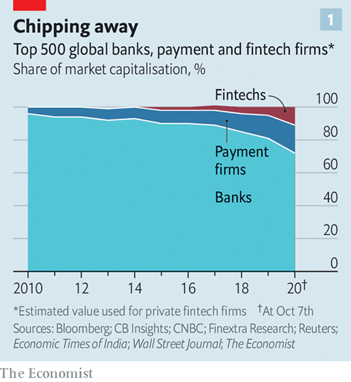

As a result, the digital wallet market, composed of services like Venmo, PayPal, CashApp, Chime, and others have grown to an over $1 trillion sector, enough to eclipse the ten largest banks in the United States combined. This is projected to increase at 30% per year going forward, to reach a $7 trillion total by the end of the decade. Note that the slice that fintech has occupied has continued to accelerate, with the market share having more than doubled over the last four years.

Legacy banks, for their part, have simply not responded in ways that have enticed new customers. Many new value offerings from banks are promotional carrots on a stick such as new electronics or material goods, or “keep the change”-style gimmicks that round purchases up and move the balance into the savings accounts. These “value adds” barely even move the needle compared to services that digital wallets have already offered for decades. Banks will spend an average of $925 to acquire a customer, compared to $20 that a digital wallet provider might need. If that user holds a checking account at a charge of $15 per month, that user will need to stay with the bank six years before the bank recoups its cost from checking account fees. Decentralized finance, in comparison, will also eat into the lending side of the bank business, as anyone can lend or borrow through a DeFi solution without proceeding through the red tape or credit checks that banks impose on customers, if the DeFi lender does not feel it is necessary.

Marketing has also proven easier for newer digital wallet providers, compared to the public relations drubbing that legacy banks have experienced in recent years, for better or worse. Banks have not quite recovered the image they lost during the Great Recession; it is difficult to imagine customers expressing excitement over their financial institution. In contrast, services such as CashApp have held onto highly expressive social media campaigns, leading to a passionate user base that has helped drive down their cost of acquiring new customers.

Changes in behavior spur new demands on institutions

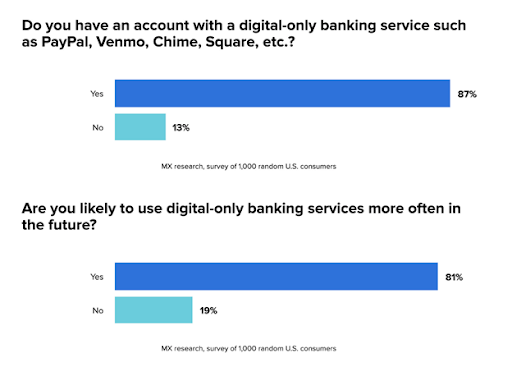

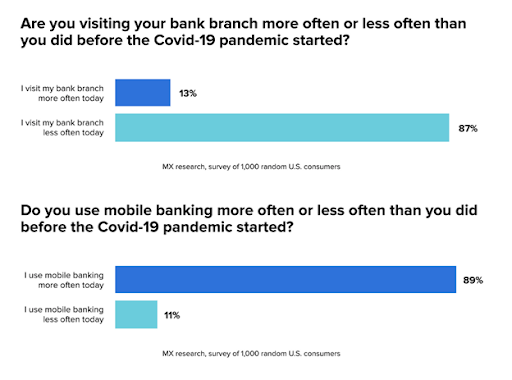

The patterns of use have changed in a way that does not favor traditional banks. A survey of 1,000 users by MX Research in March 2021 found a wide divergence in how often users choose to visit branches in person. With the tide already having turned against the pandemic at this point, it is difficult to ascribe the behavior change entirely to potential fears of illness. Further polling indicates that many users have accounts with digital-only services, and are vastly more likely to continue to use these servers in the future. It appears that customers are intending to only visit their bank physically when there is a pressing need to do so – such as conducting a wire transfer for a large, infrequent purchase, and not to perform simple tasks like withdrawing cash.

Some banks, however, are taking notes. Online-only banks have proven very popular with millennials and provide a nice compromise between digital wallets and traditional banking services. While these banks still do offer the services of brick-and-mortar locations virtually, the fact that they can eschew these maintenance costs means they can offer better rates to customers and focus on enhancing their online services to an increasingly demanding market. The biggest competition to fintech offerings going forward will not be from banks boasting hundreds or thousands of branch locations, but rather online upstarts that focus on emulating the value offerings that fintech offerings provide. What’s more, due to these cost savings, online only banks have moved away from the traditional model of charging monthly maintenance fees for checking accounts, further attempting to follow the model that digital wallets have set.

Some banks, however, are taking notes. Online-only banks have proven very popular with millennials and provide a nice compromise between digital wallets and traditional banking services. While these banks still do offer the services of brick-and-mortar locations virtually, the fact that they can eschew these maintenance costs means they can offer better rates to customers and focus on enhancing their online services to an increasingly demanding market. The biggest competition to fintech offerings going forward will not be from banks boasting hundreds or thousands of branch locations, but rather online upstarts that focus on emulating the value offerings that fintech offerings provide. What’s more, due to these cost savings, online only banks have moved away from the traditional model of charging monthly maintenance fees for checking accounts, further attempting to follow the model that digital wallets have set.

Conclusion

The rise of fintech applications will, for better or worse, force action within traditional systems. Banks that have emulated the setup of digital wallets have experienced a reward for their efforts, though one must admit that they have done so by standing on the shoulders of giants of online services that came before them. The customers have spoken, and it is clear that they require their financial services to have the same level of immediacy and urgency that the rest of an increasingly online world has provided them.

If you have questions about our fund or would like to be sent investor documents, you can contact our investor relations department at [email protected].