Digital Asset Markets in Transition

Following their recent all time highs, Bitcoin and other digital assets have recently languished farther from them than most people would like. Global economic uncertainty continues as the Russo-Ukrainian crisis supplants COVID’s weakening grip on markets. Bitcoin’s behavior has slowly changed over time to correlate more closely with traditional investment assets, which may help provide a clue as to why prices have not yet recovered.

Where the digital asset market currently sits

After reaching staggering highs of nearly $70,000 late in 2021, Bitcoin has since receded to approximately half, ping-ponging in the $35,000 to $44,000 range so far this year with brief dips below $35,000. The Crypto Fear and Greed index has been between “fear” and “extreme fear” since that point, and the market has appeared sluggish as the market wades through regulations implemented by economic heavy hitters such as China and the United States since that point. Given the length that it has held this floor, the ruling sentiment is that this is at least a short to mid-term bottom and that some level of equilibrium has been reached. But with more of the same on the horizon, it has raised the question: what’s next?

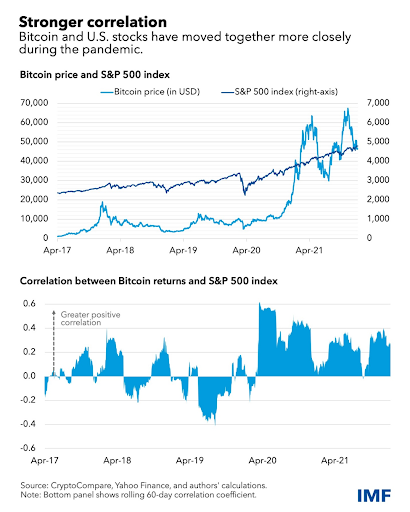

For several years, Bitcoin was viewed as a safe haven asset akin to gold, owing it shared several characteristics — most importantly a relatively known and limited supply that was perceived to be a hedge against inflation. While that is still certainly true, in terms of extreme volatility Bitcoin appears to behave more like a stock, even while gold remains flat, though the recent global crisis has resulted in the dominant store of value (gold) experiencing a +7% spurt since January 28th. The most sensible explanation seems to be that if Bitcoin itself did not change, then how people are using it changed. The tipping point appears to have been around the start of the pandemic, perhaps spurred on by unprecedented central bank action in response to it. From 2017 to 2019, Bitcoin had a correlation coefficient with the S&P 500 of just 0.01, but after 2020 it jumped to 0.36. As this correlation grows stronger, it suggests that Bitcoin has been acting more as a risky asset rather than a safe haven over the prior few years.

The prevailing theory is that as Bitcoin matures and draws more institutional investors with big pocketbooks, it is going to behave in a manner that reflects what those wallets want. There are going to be limitations, of course; Bitcoin just has too many features that make it unique that no other offering can provide on its level, such as its pseudonymity and ease of transaction across borders. But it appears that the days of Bitcoin acting purely like gold have come to a close, and they will act closer to a correlated asset than not going forward, so long as institutional interest holds. According to Binance, institutional inflows into crypto stood at $9.3 billion in 2021, and there are now 132 institutional investment products available on the market. While the jury is still out on how institutions might view an extended crypto bear market, there is much reason to believe that they are not going anywhere for the moment.

The strength of bitcoin returns

Bitcoin itself is no stranger to adverse economies, it being borne out of the subprime housing crisis that led to the Great Recession. It has seen its share of market pullbacks, and weathered the COVID pandemic surprisingly well, even reaching its all-time peak during the Omicron wave and renewed concern over the path that the pandemic was taking. It has also seen its share of crashes that it would supposedly have never recovered from, and yet every time it still managed to reach a new all-time high months or years down the line. Although it is still young as an asset class, with more than a decade of proven returns it feels more and more improbable that it is simply luck bringing them.

The unassailable fact remains, however, is that compared over the same time period since its inception, Bitcoin has outperformed all traditional assets, even after accounting for its recent downturn with an all-time ROI of 11,520%. Even over its inception the S&P 500 has only seen an ROI of 4,000%, and only 111% when constrained to the timeframe of Bitcoin – which would have to plummet even further before it even begins to resemble the returns of other assets with all other variables being equal.

What has given digital assets their staying power is that they bring use cases to the table that other assets aren’t able to meet. No other assets are as easily traded across borders at any time of day or night, avoiding as many technical pitfalls and slowdowns of traditional finance institutions as they do. Though governments have been able to stop their interactions with fiat systems such as in the case of China, they have not been able to stop their transactions – and the fact that digital assets are not beholden to intermediaries or middlemen means they are able to reach underserved populations in a way that banks have so far declined to assist. In fact, Bitcoin has already served in this role during the recent conflict; the Ukrainian government has raised some $30 million through Bitcoin to be used for humanitarian aid and military operations, while Russia has the potential to use it to sidestep sanctions and continue operations even after being cut off from the SWIFT banking system, giving Russian citizens a potential lifeline to purchase goods and services overseas. The message has been sent that your use of a particular country’s currency is tied to keeping good relations with them, and Bitcoin can fill the gap as a truly neutral medium of exchange.

Conclusion

While it may appear that Bitcoin is in a rough spot, it would be more accurate to view it as a transitory stage rather than a permanent decline. Taking a long term view of the situation shows that Bitcoin has still enjoyed staggering long-term value despite its recent trouble, and it appears that even despite the pandemic institutional investors are holding fast.

If you have questions about our fund or would like to be sent investor documents, you can contact our investor relations department at [email protected].