The American Economy Signals Significant Events Ahead

Economic Signals Portend Big Changes

Over the past year, there have been several indicators that point towards the United States moving towards a recession. Although the previously discussed trade war with China is certainly having a negative impact, there are telltale signs painting a concerning picture for the US economy. It’s important to have a bird’s eye view of what is happening in the economy as well as investment options to successfully navigate it should the worst predictions come to pass.

Inverted Yield Curve Reveals Skittish Investors

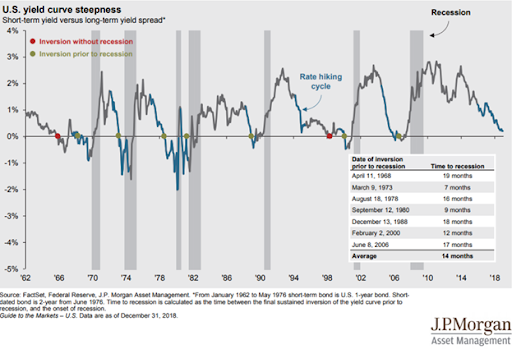

August 2019 demonstrated the most recent appearance of the inverted yield curve in the US bond market; interest rates on short-term bonds are now higher than that of long-term bonds. The inverted yield curve signifies widespread fear as investors look to pile into safer investments. A quick look at history reveals that out of the last eight times the curve inverted, it heralded an incoming recession less than two years after its appearance. While it does not mean the economy is about to immediately fall off a cliff, it does represent the need for immediate action to reconsider investment and asset allocations. Previous inverted curves were all concurrent with specific, empirical pain points in the economy, such as the 2006 housing bubble, the 2000 dot-com bubble, and the 1987 market crash.

Furthermore, on August 28, 30-year bond yields in the US hit record lows, and the curve inversion grew even further. The spread on three-month T-bill rates over 10-year yields exceeds 55 basis points; the last time the spread was this wide was immediately prior to the Great Recession.

The United States Flirts with Further Rate Cuts

On August 19, President Trump called upon the Federal Reserve to look to cut rates and engage in further quantitative easing, echoing pressure he had placed previously on the Fed. While he claimed the economy was as strong as ever, it is always wise to separate rhetoric from action and look at the possible motives for the decisions.

For better or worse, rate cuts are viewed as protective, defensive measurements, designed to stimulate borrowing as their implementation sends a fear signal to the economy. However, they can only be cut so far, and as of right now, rates are already at historically low levels. If a recession does come to pass, the Fed will have very little wiggle room. In the 2001 and 2007 recessions, the Fed needed to cut a total of 5% to get the economy back on track.

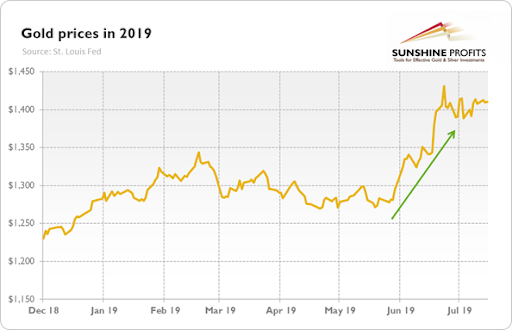

While gold prices have remained on a slow, steady upward trend through the first half of 2019, they then spiked nearly 10% further as the US-China trade war flared in intensity. Even central banks are focusing on bolstering their gold reserves, having expanded their holdings by 14% since 2009. Both global economic factors, as well as hedging against risks, have been cited for the buying spree. The combination of a sudden interest in gold and the urge to seek safer short-term bonds reveals a great deal of pessimism regarding the US economy, especially considering that it has been over ten years since the last recession; a striking length of time between cycles by historical standards. While it is impossible to predict economic cycles with certainty, it would set an incredible level of precedent if the economy were able to somehow dodge a recession given these historically accepted factors coming into play.

How Digital Assets Factor In

Meanwhile, over the same timeframe, Bitcoin is up nearly 300%.

Given President Trump’s urge to implement further quantitative easing, there are understandable concerns about fiat currency maintaining its value. Naturally, the more fiat currency that gets injected into an economy, the more it devalues. The European Central Bank is engaging in its own rounds of quantitative easing as well, and likely to proceed with yet another round in September. It’s no surprise that investors are scurrying to options where supply cannot be so easily manipulated.

As previously mentioned, even central banks are bullish on gold, while they continue to print more unbacked paper money. Digital assets represent a sort of rebellion against this status quo; since these assets are not beholden to a central bank or government and have value worldwide. This is not idle talk but has real-world implications, demonstrated by the Argentine market and currency crash after its incumbent president was defeated in a primary election. In one day, the peso dropped nearly 20%, and the Argentine stock market dropped nearly 40%. While it is not particularly likely the United States economy will see such a titanic, immediate plummet, the point has been made very clear that faith can be easily shaken in fiat currency by simple geopolitical events.

The price of bitcoin correlated with gold is no accident. What happens with the next economic cycle will be extremely telling as to the future of fiat currency. Gold has always existed as a safe haven against tough economic times, but this will be the first recession in which digital assets have existed as a feasible medium of exchange. Bitcoin was in its infancy in 2008, and no one knew at the time the incredible impact it would have on the financial world. The digital assets market is more easily accessible than gold, requiring no brokers or middlemen, and if money does exit the fiat market, it will need a place to go.

Concluding Thoughts

Digital assets are going to play a key role in the upcoming economic cycle. At this point, a recession is in the cards in the US economy; it’s not a matter of if at this point, but rather when. There are simply too many historically accepted indicators to ignore. As people continue to lose faith in fiat currency, there will be a need to fill the gap with investments that lack its drawbacks. While gold will certainly always exist as a safe haven, for the first time digital assets will provide much-needed competition and studying the market’s movements will give more data that can be used to navigate a recession.

If you have questions about our fund or would like to be sent investor documents, you can contact our investor relations department at [email protected].