Digital Assets Remain Correlated Despite Recent Events

In financial markets, correlations are commonly used to identify relationships between different assets and can be used as a measure of market risk. When it comes to traditional markets and digital assets, there is some debate over whether or not they are truly decoupled from each other. While some argue that crypto is becoming increasingly independent from traditional market movements, the truth is that it will take much longer than a few isolated events to demonstrate that decoupling. Recently, the rise in BTC price has been attributed to mistrust in traditional banks due to recent failures which has caused people to move their funds into cryptocurrencies for security and stability purposes. This could indicate that there is still a strong link between traditional markets and crypto despite its increasing independence.

How recent events show that digital assets are still correlated overall

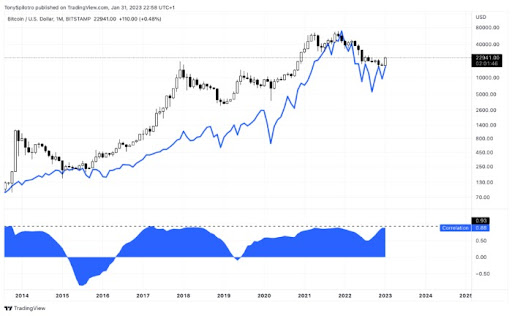

A study from Georgetown University conducted in early 2023 examined the correlation between the price of Bitcoin and the S&P, even though unprecedented black swan events such as the COVID pandemic and the invasion of Ukraine which sent both domestic and international markets into turmoil. The research found that between 2016 and 2021, the correlation index between the two assets was only 0.08. By July 2022, however, the correlation index had nearly quintupled to 0.33. The same was the case between Ether and the S&P, rising from 0.04 during the first span to 0.38 by 2022. While several years ago it may have been the case that Bitcoin and Ethereum were decoupling for a short period of time that has not been the case for some time. What’s more, the rate that they have been correlated has generally been increasing over time.

Looking at the history of the correlation index, it’s clear that while there have been some periods of time where the assets appeared to be decoupling, but the vast majority of the time has been spent above water. Many of the events that push the correlation index down are one-time events within the digital asset ecosystem, such as fallout from Mt. Gox around 2015 and FTX in early 2023. However, when left to its own devices and without having external events such as fraud placing their thumb on the scale, the index will always tend towards some level of correlation.

How those events have affected the correlation ratio temporarily

Over the last month or so, the correlation ratio for Bitcoin has dropped to about 0.30, leading some individuals to claim that it is on its way to becoming an uncorrelated asset. However, this decrease is linked to a combination of several one-time affairs that are not believed to have a long-term lasting effect on the status of this correlation. A factor such as the level of institutional investor interest in Bitcoin is much more likely to determine this status — so it’s important to not get too hung up on individual events which can create a mirage effect and lead to suboptimal decisions.

For one, Bitcoin is experiencing an inflow of capital, albeit not an all out bull run, seeing an increase of approximately 60% since mid-December following the FTX crisis. This run has been sparked by two primary ingredients: the predicted recovery over time following FTX, and then the collapse of Silicon Valley Bank combined with a lack of trust in the U.S. banking system. Any indication of weakness in the banking system has always triggered interest in cryptocurrency, and this event was no exception. The collapse in mid-March ended up doubling the effect of the run up from 30% to 60%. The Silicon Valley Bank collapse has been a major driver of this positive price action for Bitcoin because when traditional banking institutions are unable to pay out or provide adequate services, many people instinctively flock to alternative assets. Digital assets offer an escape from the status quo and offer users the possibility of generating returns without having to be subjected to the crises besetting traditional markets. This is especially attractive during times of uncertainty, when investors are more likely to seek more reliable sources of returns than traditional markets can provide.

The recent surge in Bitcoin may have been triggered by these events, but it doesn’t mean that digital assets are no longer correlated with traditional markets. In fact, what we’ve seen is a short-term disruption in the correlation index; once these events fade away, we may see the correlation index start climbing back up again. The key takeaway here is that while Bitcoin’s relationship with traditional finance is far from being attached at the hip, it still cannot be ignored and must still be taken seriously. Moreover, it’s clear that during times of market volatility the correlations between cryptocurrencies and traditional markets become stronger. During periods such as Black Thursday in early 2020, where stock markets crashed due to the spread of COVID-19, Bitcoin saw a dramatic drop in its value alongside other assets while correlations between crypto and traditional markets increased exponentially across the board. This is indicative of the fact that when the global financial system experiences turbulence it often impacts digital assets as well. While there are some specific events such as bank failure which tends to impact one asset class more than the other, the overall picture still leans towards correlation.

Conclusion

It is evident that while traditional markets and cryptocurrencies may not be permanently coupled, they still maintain a strong correlation. During times of market volatility or when external events such as bank failures occur, the correlations between crypto and traditional assets become even stronger. This demonstrates how digital assets are affected by global financial systems and how their values can often move in tandem with one another during tumultuous periods. Therefore, it is important to take into account both asset classes when considering investment strategies for future success.

If you have questions about our fund or would like to be sent investor documents, you can contact our investor relations department at [email protected].