Blackrock Submits Spot Bitcoin ETF Fund Application to SEC, Other Firms Follow Suit

In a watershed moment of mainstream validation for Bitcoin, asset management firm BlackRock has submitted an application to launch an exchange-traded fund (ETF) that tracks the price of Bitcoin. If approved, this fund could potentially be the first Bitcoin fund to be officially approved by the SEC, which could be the foot in the door to usher a properly regulated and accessible path to Bitcoin for Wall Street. Let’s look at how the application has progressed, and where it might go from here.

How the application is progressing

Blackrock’s application to the SEC began on June 15th, and as applications take time to review, it may be some time before we hear whether or not the SEC approves it. Although the SEC has approved digital asset related products before, they have only done so with companies that have an indirect relationship, whereas Blackrock’s offering is a Bitcoin spot ETF, the likes of which have been shot down every time to date by the SEC. Such an ETF would allow institutional investors to be exposed to Bitcoin directly without having to buy the asset directly. Blackrock is partnering with Coinbase as its custodian, which would make it one of the largest institutional partnerships with digital assets to date in the United States. In early July, the SEC indicated that they felt the filings were unclear and incomplete, though Blackrock, not to be returned, re-filed an amended application a few days later.

Given recent events, it’s easy to imagine there is a lot of skepticism on the part of the SEC towards Bitcoin, but it appears that Blackrock is trying a different tack than previous applications and is proactively working to allay any potential concerns that the SEC might raise. The original application came only a few days after the SEC filed its lawsuits against Coinbase and Binance, although Blackrock’s application also goes into depth in how it will prevent concerning situations, such as those posed by FTX and other recent players in the digital asset sphere.

Following Blackrock’s application, other organizations that had previously filed spot Bitcoin ETF applications are also now trying again. Fidelity is once again filing an application for its Wise Origin Bitcoin Trust previously rejected by the SEC, along with other firms such as Invesco and WisdomTree. It appears that all players involved have also similarly amended their applications to address how they will prevent another FTX debacle. If the SEC does end up approving any spot ETF fund, they may feel compelled to approve more than one to avoid the appearance of favoritism towards any particular firm.

How this has affected the market

Bitcoin has enjoyed a healthy price jump since the news broke, with a 19% jump following the date of the announcement. Despite the original application being declined, there appears to be a great deal of optimism around the prospect of a spot ETF launch. Asset managers are displaying a great deal of persistence in attempting to get their funds approved that has not been observed recently, and the market appears to be taking notice. An acceptance of such a fund would be a healthy shot in the arm for markets, especially in the wake of managing so much news from bad actors over the past year.

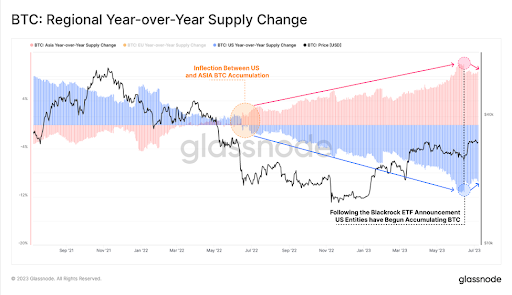

Moreover, according to Glassnode, there has also been a notable uptick in the amount of Bitcoin being held and traded in the United States, to the point where the US has actually reclaimed the leading slice of the overall supply pie. As expected, also points to another dramatic increase in interest within US-based entities, as this would make exposure to Bitcoin to US residents a much easier process if it can be traded through a spot fund within US markets.

Looking further down the road, we may be poised for a “perfect storm” for Bitcoin as all the pieces begin to fall into place. The next Bitcoin halving is now less than a year away, which historically has led to a huge jump in prices as the incoming supply of the coin becomes further constrained. If any of the spot ETF fund applications are approved, it could potentially lead to a meteoric spike in prices as exposure to Bitcoin in the United States becomes easier than ever before just as the new supply of coin tightens further, and such a decrease in supply and increase in demand will most certainly lead to a large upswing in price. Already, there are signs of “whales” accumulating further coins, as CryptoQuant has shown that Bitcoin outflows have dominated inflows over the past month. With the way the market pieces are positioning, we may be entering a stage where all loads could read to victory; for example, even if the spot ETF does not take off, the halvening itself is still likely to have positive pressure on its own. Even if only some of the pieces fall into place, we could be looking at a healthier market overall nonetheless, and if they all do, then the sky would essentially be the limit.

Conclusion

After the drubbing the markets have taken over the past year, there is clearly room for optimism and there are very positive signs that the market is looking to break out of its doldrums. Although spot ETFs have been proposed and rejected before by the SEC, there is an unusual sentiment of optimism as well as the community clearly looking to show that it has learned from its prior mistakes by attempting to present more amenable terms to the regulatory body. With the halvening on the horizon and people looking to invest as to not miss out on the historically-demonstrated price jump, as negative a year for Bitcoin this has been, the next year could potentially claw all of that back and then some.

If you have questions about our fund or would like to be sent investor documents, you can contact our investor relations department at [email protected].