How to Read Bitcoin After The Price Drop

Bitcoin experienced a massive sell-off over the prior month, spurred on by uncertainty over adverse market conditions, scrutiny over products promising high yields such as Celsius and TerraUSD, and potential action by the Federal Reserve being considered to counteract rampant inflation in the United States Dollar. While the price drop may seem precipitous, over the long term Bitcoin has remained a strong competitor to the dollar, even in a bear market specific to digital assets.

Inflation’s recent spike – and its long term effects

Inflation in the United States topped 8.6% in May following a 5.5% raise in April, marking two of the biggest single-month increases since 1975. This occurred after diesel fuel hit an all-time high of $5.16/gallon in April, a nudge higher from its previous all-time high of $5.15 in March. The supply of diesel fuel has been constrained by the ongoing war between Ukraine and Russia, as sanctions laid on Russia have cut off much of the world from their fuel exports. The price of diesel fuel is one of the primary drivers of inflation, since any costs involved in transporting goods will inevitably get passed along to businesses and consumers. Not only do trucks and freight trains use diesel, but airplanes also use a variant of the same kind of fuel, so the effects of a constrained flow of diesel touches every part of the supply chain. While electric trucks have begun to roll out, it will be several years before they are able to make a meaningful dent in diesel fuel demand.

(Source: The New York Times)

Although the recent spike in inflation is concerning on its own, what’s more important to realize is that except for some very brief, extreme circumstances, the US dollar has lost some of its value every single month. There is no bank that you can store USD in that will allow you to keep the entirety of its value month after month – many banks offer a tiny fraction of a percent in interest, and even banks that offer more still adjust their interest payments as the prime rate and other market conditions move, meaning that they will only be able to mitigate the effects of inflation at best. On a long enough timespan, any amount of money held at rest will eventually be slowly chipped to worthlessness through the march of inflation; while the actual level of inflation will vary, its presence in a fiat currency can be considered a certainty. Holding money with the prospect of expecting its value to rise through deflation will never be a viable strategy. The only way to put your money in a place where it will actually outpace inflation is to embrace some level of risk.

Why to keep using Bitcoin as a store of value

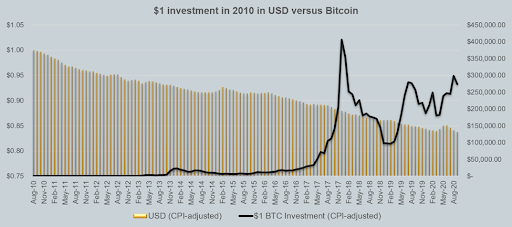

Bitcoin has had an exceptionally rough last month, as it fell below the $20,000 mark before bouncing back slightly. On a wider scale, this isn’t anything the market hasn’t seen before. Bitcoin fell to 20% of its all time high going into 2019, and also fell to half of its all time high in 2021 before finding a new all-time high in short order. Even with such a monumental price drop, in the span of 2017 through 2020 Bitcoin was actually a superior holder of value compared to USD, and it took a near catastrophic market shakeup for it to dip below the dollar. Even when it did, it wasn’t by much, and it was only below the dollar for a few months at that.

(Source: CoinTelegraph)

Whenever there is a large price drop in Bitcoin, its prospect as an anti-inflationary store of value gets questioned, but the criticism is aimed at what has historically been a very brief puddle where Bitcoin gets outperformed by the dollar for a few months. The criticism is often more concerned at pointing out that the dollar is outperforming Bitcoin in the present time, without consideration for the fact that it historically does not spend a very long time there, nor the fact that when Bitcoin is on top over the dollar as a store of value, it is also typically a much more commanding lead than the dollar has when it is on top over Bitcoin. The criticism also appears to hold a level of weight as at the moment it is technically true, but is more rooted in emotion in regards to a recent market drop rather than long-term prospects.

It’s also important to notice the trends that the two lines follow. As stated, the value of the dollar has only one choice – to trend downward over time. Bitcoin, on the other hand, while it objectively has more short term risk than the dollar, it actually has the option of its value rising over time as its supply drops through future halvings and coins being taken out of effective circulation due to users losing keys.

Out of any particular group of market participants, few have done better than the ‘hodlers’ – those that have simply continued to buy and hold onto Bitcoin and use it as the store of value that it was designed to be. Even the most liquid of investment vehicles such as stock accounts still take three days to clear, while others may tie up funds for much longer, whereas Bitcoin is available at any point, day or night. If an individual were to simply keep all their money in Bitcoin as one might use a checking account and simply deposited and withdrew funds as needed without concern for the market state, they would inevitably find themselves further ahead in terms of monetary value than someone using traditional banking for the same purpose.

Conclusion

The price drop is nothing that Bitcoin has not seen before. It appears that the $20k level has been tested quite rigorously at this point, as it has held for several days even in an environment of intense fear. History has shown that even in the face of prior price crashes, long-term holders of the coin inevitably find themselves ahead in the long run, and this may be a great time to help bolster reserves at a premium price.

If you have questions about our fund or would like to be sent investor documents, you can contact our investor relations department at [email protected].