Bitcoin Accessibility Marches On as Rally Continues

Bitcoin’s Rally Continues On Unabated

Bitcoin’s massive rally at the end of 2020 and proceeding into 2021 is no accident. One of the most common phrases among investors when comparing it to 2017’s rally is “this one is different.” 2017’s infamous rally and then crash was driven by speculation – when the house of cards fell, there was no real weight or backing behind it. What makes 2020 different is that the house is built on rock rather than sand, with an ever-swelling user base and the financial investment of some of America’s biggest institutional players.

How “This One is Different”

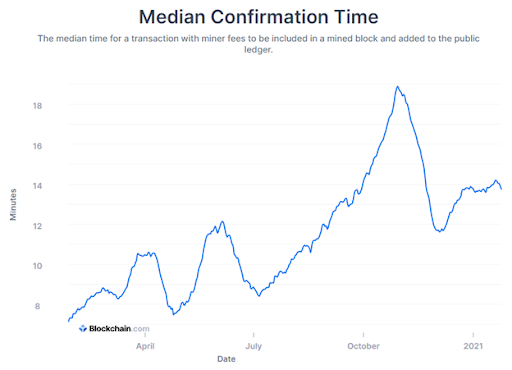

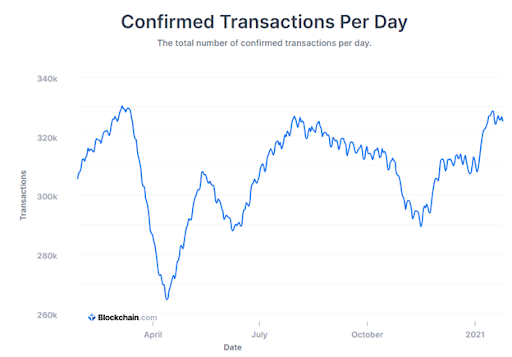

One of the primary reasons for Bitcoin’s price continuing to surge is simple: it’s improving at being the medium of currency it was designed to be. Entrenched financial providers such as credit card issuers provide instant access to funds, so Bitcoin must be able to compete. In the past, Bitcoin has struggled with increasing confirmation times. However, due to software improvements and increasing hashing power being devoted to the network, this has become far less of an issue. The median confirmation time has fallen to half of what it was just a few months ago – an impressive feat, to be sure, but even more so when contrasted against the transactions per day climbing 10% over that same period.

Secondly, the number of users in the ecosystem has also rallied to its highest point in years. Major players like PayPal have integrated Bitcoin into their platforms and introduced it to a new, untapped userbase. It is now easier than ever before to purchase Bitcoin, and that’s reflected in the number of unique users which is the highest it’s ever been, outside of a spike in 2017 that dissipated as soon as it arrived. However, 2017 was driven by the unhealthy ICO craze that regrettably produced fraud alongside legitimate investments. What’s different now is when money moves from fiat to bitcoin, it now stays there, evidenced by the consistently increasing flows through crypto-to-fiat exchanges. Unlike 2017, these exchanges are witnessing more activity as individuals seek to buy and hold bitcoin. As of the writing of this article, 77% of bitcoin (14.8 million) is held in illiquid wallets where it has not moved in more than five years.

Facebook, another heavy hitter, also announced in December that its cryptocurrency Diem (formerly Libra) is set to launch in early 2021 once its long-standing regulatory hurdles are finally cleared. With over 2.7 billion active user accounts, Facebook is still poised to bring digital assets to the mainstream. Should Diem be listed on exchanges where it can be traded for bitcoin, it could potentially be a way for yet another untapped market to be brought into the bitcoin mainstream. With each new institution showing its determination to introduce digital asset access to the masses, the general use case for Bitcoin becomes more and more evident to the average user.

The digital asset model even continues to find its way into innovations not wholly related to monetary transactions. Chrissa McFarlane, CEO of Patientory gave an interview this month in which she described the use case for her PTOY coin, which secures and verifies private health information for patients on their network. PTOY coins are also awarded to users when they meet monthly wellness goals. These coins can then be potentially traded for other coins, giving individuals elementary exposure to Bitcoin without even spending a dime of their own money.

Institutional Investment Backs Ever-Growing Markets

Additionally, institutional investors increased their investment into digital asset funds to $5.75 billion overall in 2020, representing a 660% increase compared to 2019. The largest asset fund, Grayscale, held an overall $20 billion. Michael Sonnenshein of Grayscale commented that “… the fact that bitcoin is a verifiably scarce asset. It’s limited in quantity. And they think about that in the context of all the quantitative easing and perpetual money printing that’s taking place in the fiat currency world, and why their portfolios warrant an asset that has verifiable scarcity.” With both the prior and now current United States administrations pushing for additional $1,400 checks to be sent out, representing the single largest stimulus yet, it’s evident that the idea of Bitcoin acting as a hedge against inflation isn’t going away anytime soon. Stan Druckenmiller agreed when he indicated with the caution that he owns more gold than Bitcoin; “if the gold bet works, the bitcoin bet will probably work better… because it’s thinner, more illiquid, and has a lot more beta to it.” Although some investors still prefer gold, the overall consensus that continuing stimulus in the face of the pandemic will contribute to the weakening of the dollar seems nearly unanimous.

Bond rating and investment firm S&P has weighed in on cryptocurrency as well, and the voice of such a long-standing investment hallmark cannot be ignored. In their January report, while they cautioned that “lingering technology and exchange counterparts risks remain”, they acknowledged that parallels between bitcoin and gold have grown, and are viewed as scarce with values that cannot be inflated by currency creation, and that they are both uncorrelated assets and can be considered to have diversification benefits. The main difference, they noted, is that gold does not yet have a ceiling to supply, while the eventual total supply of Bitcoin can be noted. Also note, however, that the eventual finite supply is known and immutable, Bitcoin is also destructible, such as if wallet keys are lost or destroyed – so the amount of Bitcoin available is also stochastically decreasing at some level, and a gap of unknown but always-increasing size exists between the theoretical and actual supply. The S&P report follows the December 2020 announcement that it will launch a digital asset indexing service in 2021, partnering with data provider Lukka. Peter Roffman, global head of innovation and strategy at S&P noted that digital assets are generally at a point of mature institutional interest, and expressed a desire to contribute to the marketplace’s transparency.

Concluding Thoughts

The institutional investments Bitcoin has enjoyed over the last six to twelve months will provide the backing the asset class needs to succeed in the future – and the swelling user base will ensure that it’s not just meaningless tokens being traded back and forth. Every month there appears to be a new investor jumping into the space, and in the case of Facebook, PayPal, and others, they are bringing their user base with them and introducing their users to what digital assets can offer them.

If you have questions about our fund or would like to be sent investor documents, you can contact our investor relations department at [email protected].